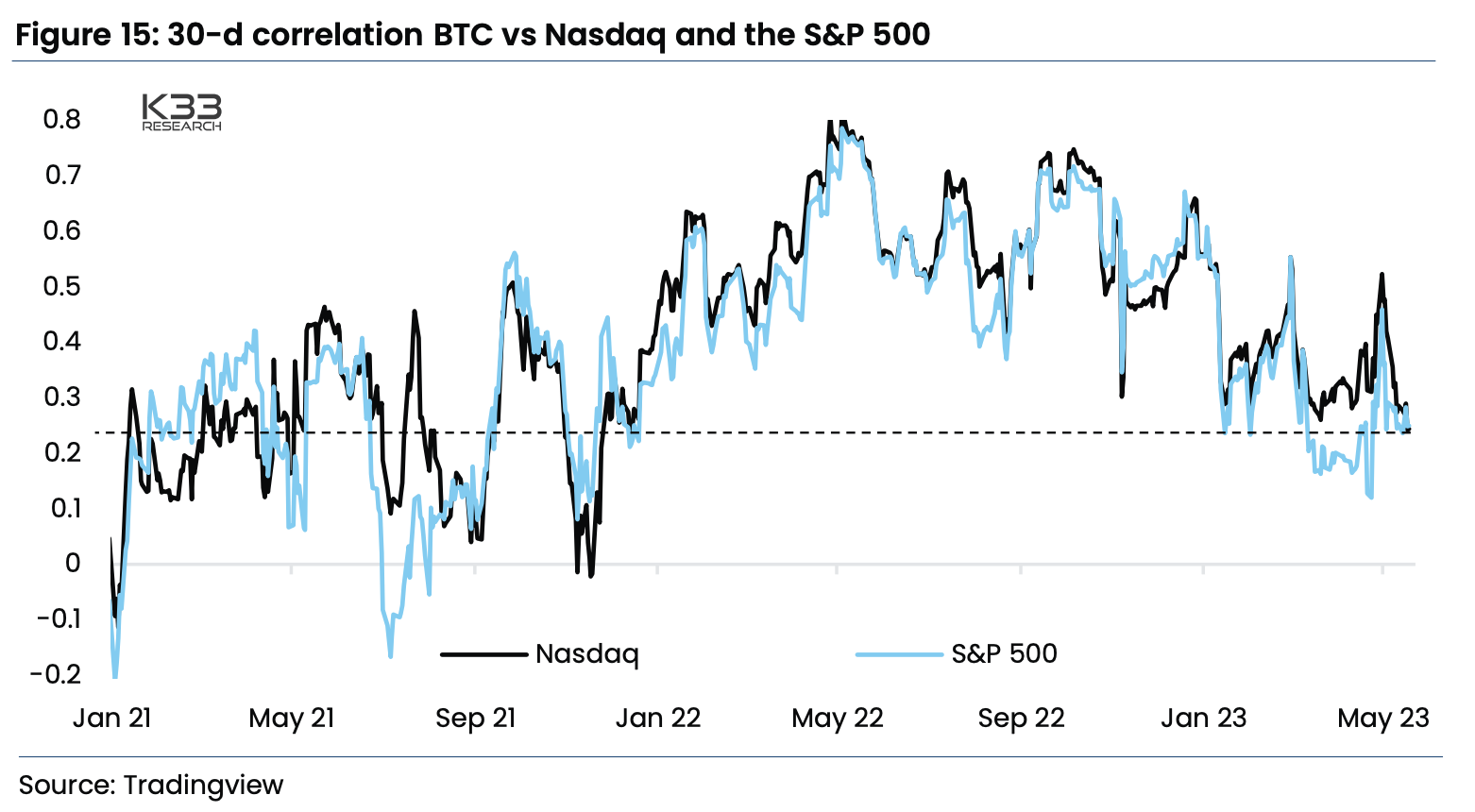

The correlation of BTC’s price with the NASDAQ index has fallen to 17-month lows, making the asset attractive again for portfolio diversification, crypto research firm K33 noted.

A declining correlation between bitcoin (BTC) and equities is rejuvenating the case for investors to include the asset in a more diversified portfolio, crypto market research firm K33 noted in a report.

BTC’s 30-day price correlation with the tech-heavy NASDAQ index fell to 0.26, its lowest level since December 2021, according to K33 data. BTC’s correlation with the S&P 500 index also plummeted last month to levels not seen since late 2021.

Bitcoin, the largest cryptocurrency by market capitalization, has lured investors over the years as an asset whose price moves independently from other investment classes, most prominently from equities, making it convenient as part of a diversified portfolio.

The narrative, however, changed last year, as the digital asset market nosedived from all-time highs in tandem with stock markets. Crypto’s correlation with traditional markets rose to new highs as central banks globally jacked up interest rates at the fastest pace in decades to combat rampant inflation. The monetary hawkishness knocked down the price of rate-sensitive, risky assets such as stocks and cryptocurrencies.

“A perverse focus on growth and wide mania across the financial markets enabled the high correlations,” K33 wrote in the report. “Now conditions have calmed. Hence, BTC may again resume acting as a solid diversifier.”

BTC as portfolio diversifier

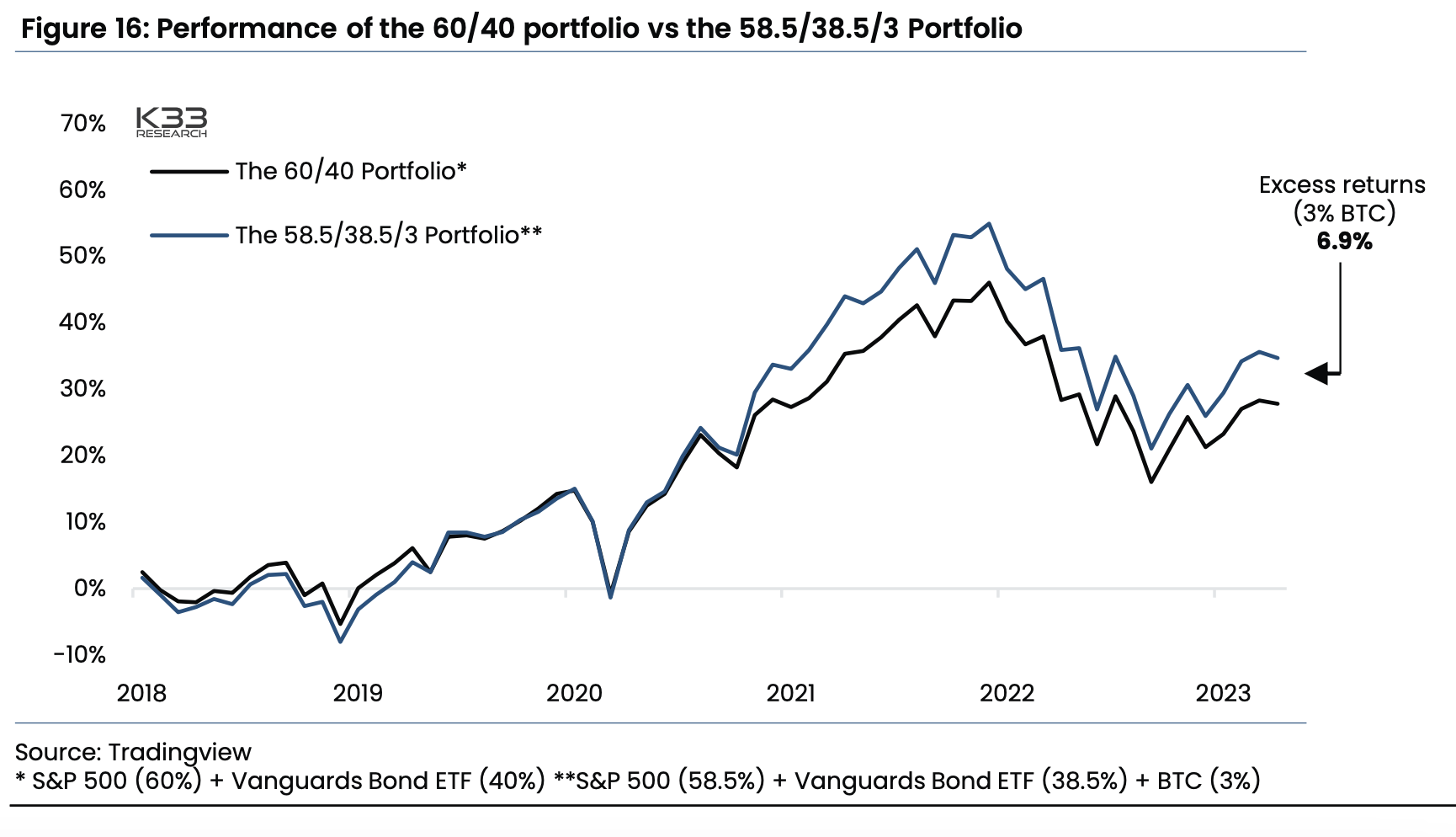

K33 found that a small allocation to BTC improves the performance of a traditional investment portfolio.

A portfolio with 3% weight in BTC, 58.5% in stocks and 38.5% in bonds has outperformed the classic 60% equities, 40% bonds investment over the years. Even when it’s measured from January 2018, near when cryptocurrency prices entered a two-year bear market, the portfolio that included BTC would have outperformed by 6.9%, according to K33.

“While the considerable price fluctuations may disincentivize investors, a time-tested strategy of active disciplined rebalancing and a minor allocation to BTC has proven to improve the overall risk profile of a traditional portfolio,” K33 wrote.

Source:coindesk.com