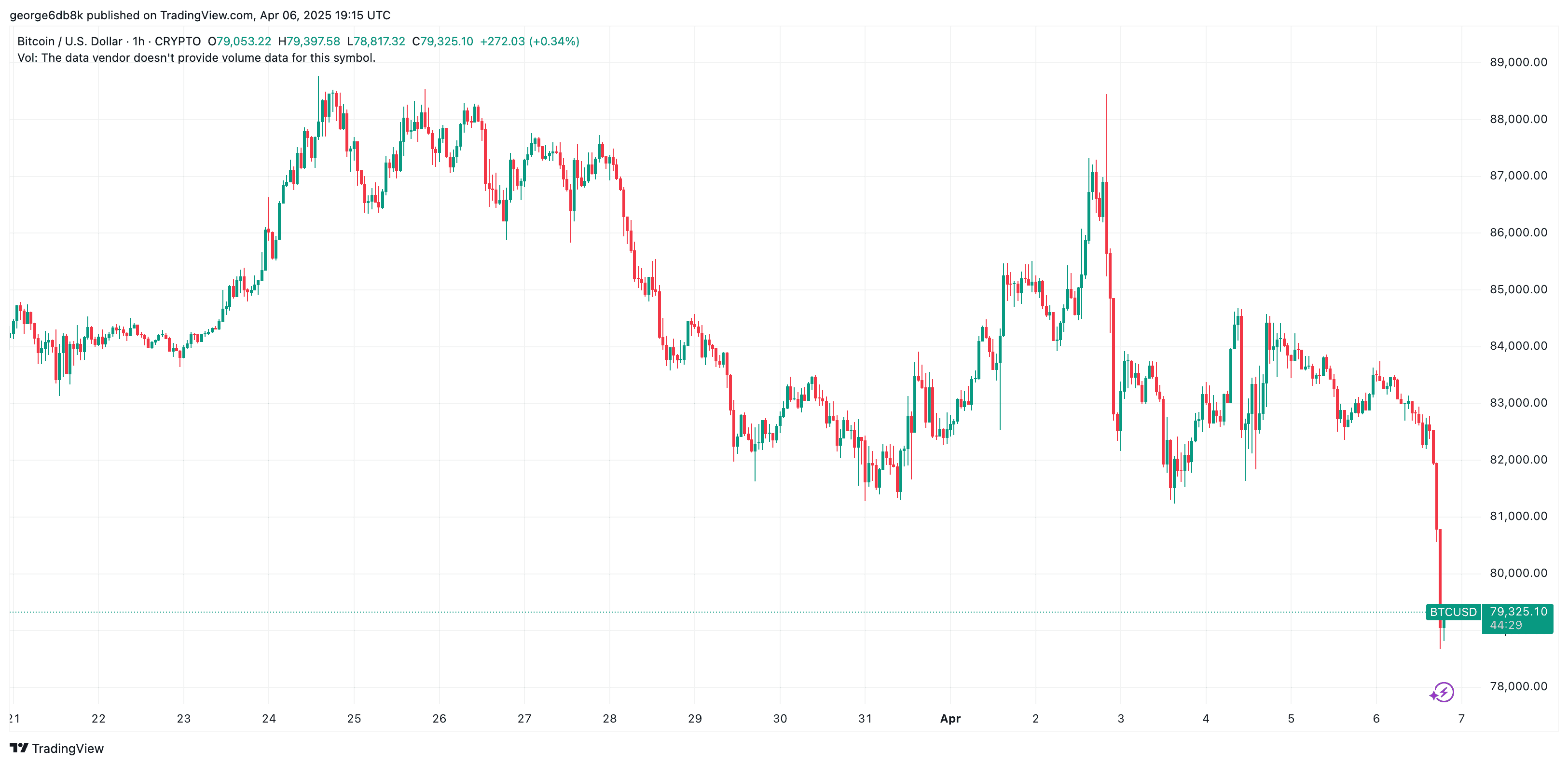

Bitcoin’s price dropped suddenly in the past few hours, tanking from slightly less than $83,000 to below $79,000.

In doing so, the market saw a spike in liquidation levels, as leveraged positions worth almost $600 million were wiped off, according to data from CoinGlass.

The move comes following a few ‘calm’ days during which BTC was outperforming major indices, prompting many to outline its properties as digital store of value.

Commenting on the matter was Jonatan Randing, a popular analyst, who outlined that BTC appears to be on its way of hitting the Weekly 50 EMA, which has historically acted as a good level of support during bull markets, promptly asking the question if we are in a bull market at all.

Bitcoin about to hit the Weekly 50 EMA – Historically a good level of support in bull markets.

But are we in a bull market? pic.twitter.com/otbb0xUzpw

— Jonatan Randin (@JonatanRLZ) April 6, 2025

Meanwhile, the markets are under serious tension in anticipation of reciprocal tariffs on behalf of the European Union, following Trump’s decision to impose a 20% levies on EU imports.

It appears traders are bracing for a ‘bloody’ market open on Monday following what was the worst trading week for major indices such as the S&P 500, NASDAQ 100, and the DJI since the COVID crash in 2020.

Source:cryptopotato.com