Friday’s Crypto ETF Frenzy

Friday’s Crypto ETF Frenzy

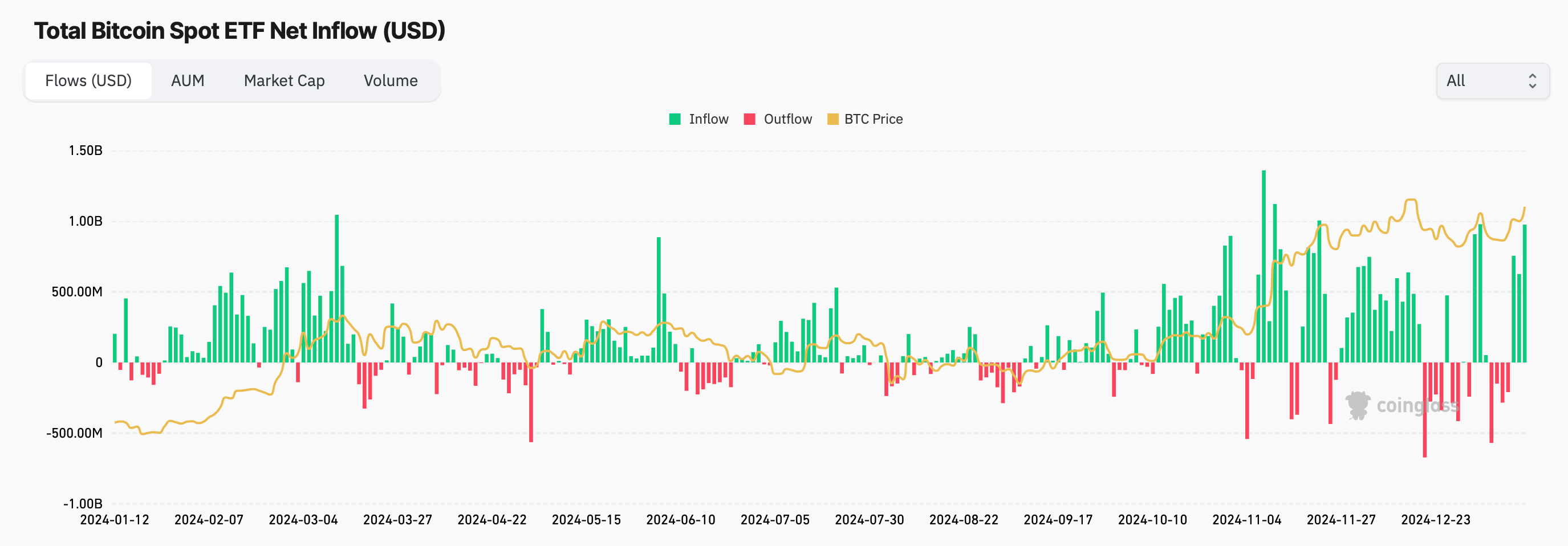

In the bitcoin ETF domain, Blackrock’s IBIT emerged as the dominant recipient, attracting $375.92 million in capital allocations. Fidelity’s FBTC trailed with an impressive addition of $326.26 million. Bitwise’s BITB garnered $208.07 million, while Grayscale’s Bitcoin Mini Trust secured $21.82 million in inflows, reflecting continued interest in diversified exposure to bitcoin.

Grayscale’s primary GBTC fund recorded an additional $20.76 million in inflows, while Vaneck’s HODL fund collected $11.91 million. Invesco’s BTCO added $6.28 million, and Valkyrie’s BRRR brought in $3.72 million. Meanwhile, Wisdomtree’s BTCW accounted for $4.47 million. These collective gains elevated the total net inflows since Jan. 11, 2024, to an impressive $38.08 billion.

Approximately $5.44 billion in trades were executed across the spot bitcoin ETFs on Friday, with the combined holdings of these 12 funds now reaching $120.95 billion in bitcoin reserves—representing 5.84% of the cryptocurrency’s total market capitalization, according to sosovalue.com’s recorded metrics.

On the ethereum side, three of the nine spot ETH ETFs captured $23.87 million in new inflows, pushing cumulative net inflows since July 23 to $2.66 billion. Fidelity’s FETH led with $13.99 million, while Blackrock’s ETHA added $7.38 million. Bitwise’s ETHW rounded out the gains, amassing $2.5 million.

The ethereum ETFs processed $393.43 million in trading volume on Friday, with their collective reserves now standing at $12.66 billion. This figure corresponds to 2.99% of ether’s overall market capitalization, according to sosovalue.com stats.

The influx of capital into both bitcoin and ethereum ETFs underscores a deepening interest from institutional players, further embedding these vehicles as pivotal conduits between traditional finance and the burgeoning cryptocurrency sector. The accumulation of reserves not only signifies confidence in digital assets but also highlights their growing integration into mainstream financial portfolios.

Source:news.bitcoin.com