In Brief

- Ethereum (ETH) faces challenges, with metrics suggesting a struggle to surpass $3,000 due to selling pressure.

- Rising exchange inflows and a negative Coinbase Premium Gap indicate selling trends, limiting upward momentum.

- Ethereum’s price risks dropping to $2,208 unless broader buying pressure rises and boosts its price above $2,600.

Despite the rising optimism surrounding Ethereum’s (ETH) potential this month, the cryptocurrency may struggle to hit the $3,000 mark. This forecast contradicts investor expectations, especially after the widespread enthusiasm for “Uptober” as last month concluded.

From an on-chain and technical standpoint, this analysis highlights three key hurdles that could prevent Ethereum’s price from breaking through the $3,000 barrier, keeping it below the threshold in the near term.

Data Reveals Ethereum Investors Are Selling

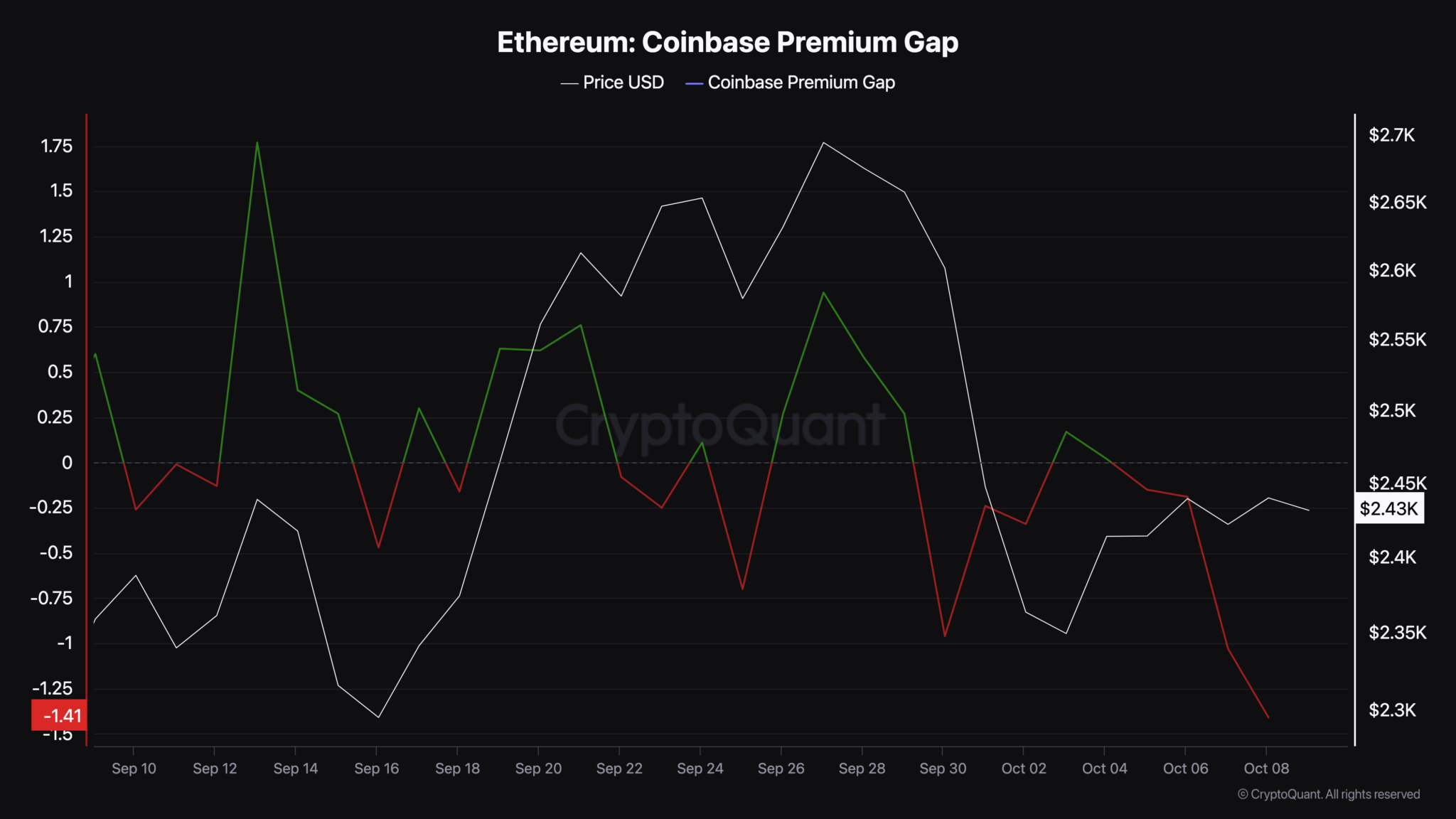

One indicator that supports this thesis is Ethereum’s Coinbase Premium Gap, which tracks the activity of US investors. High values of the Coinbase Premium Gap indicate buying pressure from investors in the country.

Low values, on the other hand, suggest rising selling pressure. On September 27, the premium gap was 0.94, which coincided with ETH’s price increase to 2,694.

However, as of this writing, the reading has dropped to -1.41, indicating that market participants have refrained from buying ETH. Instead, most are selling, suggesting that the cryptocurrency might not experience a significant upward trend anytime soon.

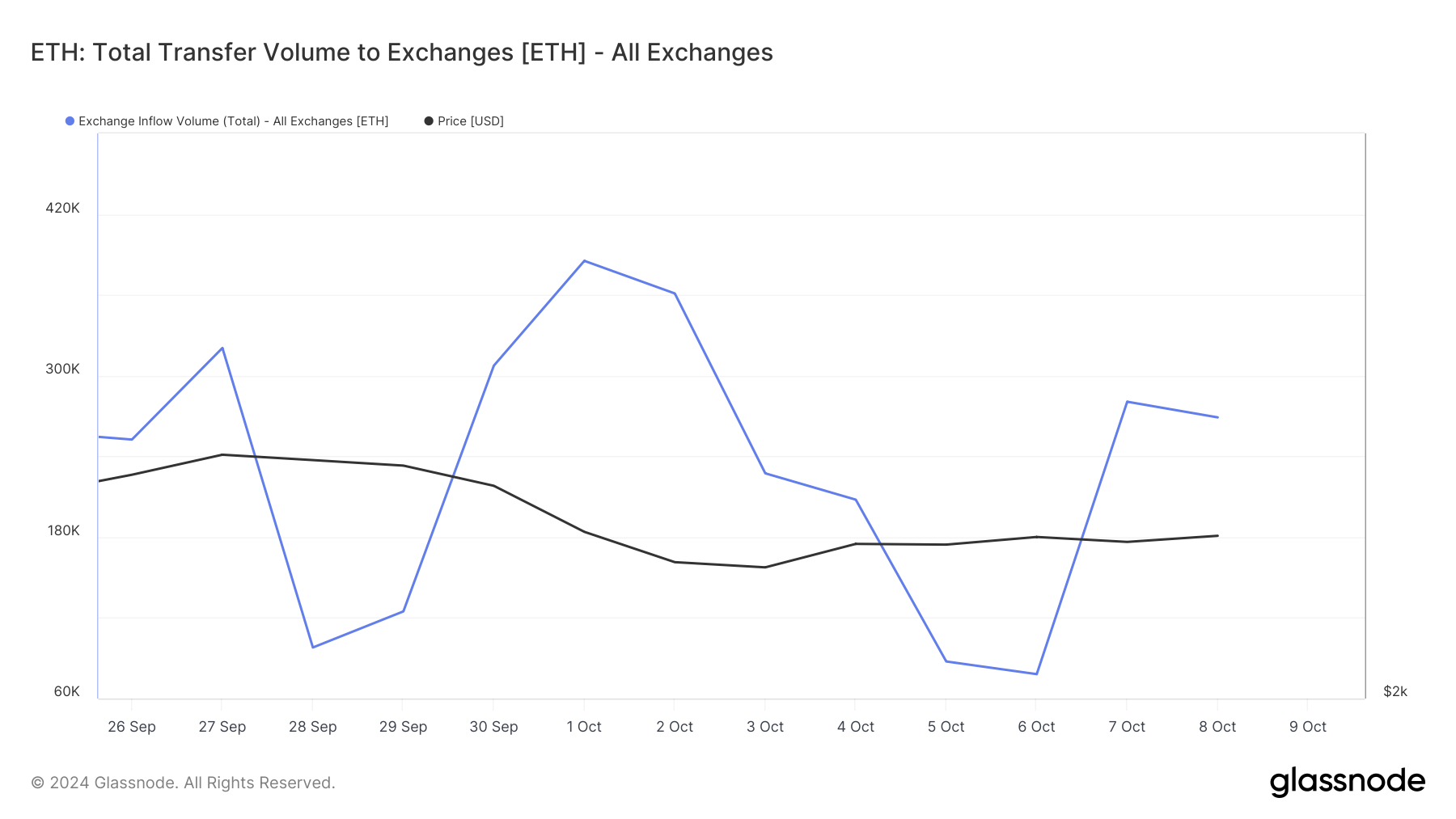

In addition, data from Glassnode reveals a sharp rise in the amount of ETH flowing into exchanges. On October 6, the total exchange inflow stood at 78,127 ETH, but it has now surged to 268,956 ETH — a threefold increase in less than five days.

This uptick suggests that some holders are losing confidence in Ethereum’s near-term prospects and are selling before further potential price declines. The increase also indicates that, beyond US investors, a broader group of ETH holders is offloading the altcoin. If this trend continues, Ethereum’s price could face considerable downward pressure.

ETH Price Prediction: Down Only

Based on the 4-hour chart, Ethereum is currently trading at $2,468 and has been moving within an ascending triangle since July. While this pattern can signal either a bullish or bearish outcome, the chart suggests that ETH is more likely to break below the triangle than break out of it.

Given Ethereum’s current weakness, the cryptocurrency could drop to $2,208 rather than rise beyond $2,600. However, if buying pressure increases, this outlook could be reversed.

For this to happen, demand for ETH would need to come from multiple regions, not just the US. If so, Ethereum’s first target could be $2,709, with the potential to climb above $3,000 thereafter.

Source: beincrypto.com