Quick Take

- Republican Majority Whip Tom Emmer got into a heated exchange with SEC Chair Gary Gensler during Tuesday’s hearing.

- Some lawmakers have criticized the SEC’s approach to regulating crypto over the years and say rules are not clear for the industry. Others say the SEC is doing its job by protecting investors.

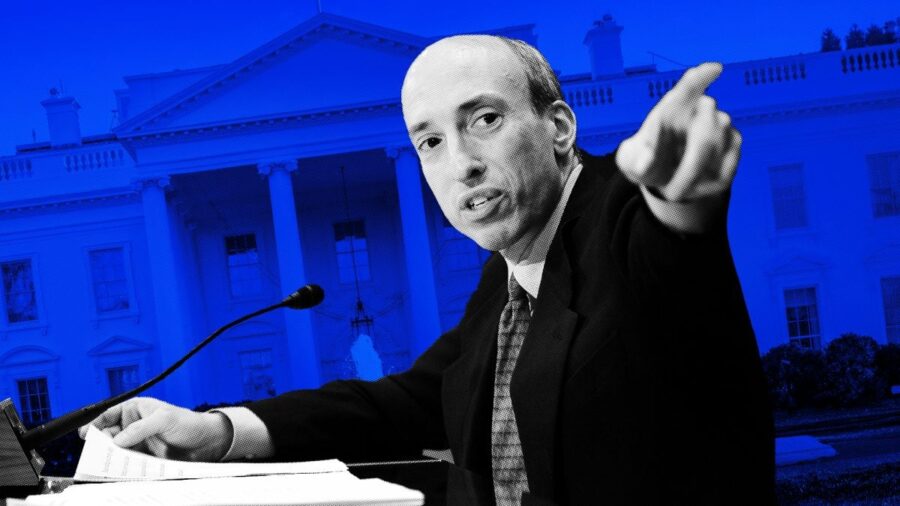

U.S. Securities and Exchange Commission Chair Gary Gensler took the heat from both sides of the aisle during a congressional hearing over his handling of regulating the crypto industry.

In an intense exchange during a House Financial Services Committee hearing on Tuesday, where all five SEC commissioners were testifying, Republican Majority Whip Tom Emmer asked the SEC chair about its case involving crypto startup DEBT Box.

A federal judge in Utah criticized the SEC’s handling of the case and said the agency acted in bad faith. The agency was ultimately ordered in March to pay sanctions, including attorney’s fees and costs. The same judge also criticized what he characterized as the SEC’s misleading statements, with the agency admitting it had fallen short of expectations.

“Does the fact that we’re talking about this today even slightly embarrass you?” the Minnesota Republican asked.

“The matters in that case were not well handled,” Gensler responded.

Some lawmakers have criticized the SEC’s approach to regulating crypto over the years and say rules are not clear for the industry. Others, including top Democrat Maxine Waters say the SEC is doing its job by protecting investors and “ensuring our capital markets remain the envy of the world.”

Tuesday’s hearing also comes as elections are just around the corner where crypto has become a hotly contested issue. Crypto firms have so far spent $119 million in 2024, with almost all of the funds going into super political action committees, specifically the Fairshake PAC, according to a report last month from consumer advocacy group Public Citizen.

Emmer, who has been critical of the SEC chair, also asked Gensler about Vice President Kamala Harris’ comments over the weekend about crypto. Harris said she would “encourage innovative technologies like AI and digital assets while protecting consumers and investors. We will create a safe business environment with consistent and transparent rules of the road,” according to Bloomberg.

“Is this your approach too sir, or do you think she’s rebuking you because she doesn’t think you’ve done a good enough job establishing these clear rules over the last three years of her administration?” Emmer asked.

Gensler said laws are in place, but that Congress can change them.

Take me out to the ball game

Democrat Ritchie Torres also peppered Gensler with questions about how the agency defines securities, using a New York Yankees ticket as an example. The crypto-friendly lawmaker asked Gensler if selling a Yankees ticket to him would be a security and later pointed out that the ticket would give him “access to a Yankees game.”

Torres’ line of questioning comes after the SEC has charged multiple entities with unregistered securities offerings, including Stoner Cats 2 LLC for conducting an unregistered offering of NFTs that brought in $8 million from investors.

“From the standpoint of federal securities laws, is there a legal difference between buying a Yankee ticket that offers you the experience of a Yankee game and buying an NFT that offers you the experience of an animated web series?” Torres asked.

Gensler said it’s about how something is offered and sold and if people are “looking to a common enterprise anticipating profits,” citing the Howey Test. The test is based on a 1946 U.S. Supreme Court case frequently cited by the SEC, to determine if an asset qualifies as an investment contract and, therefore, a security.

“The expectation or promise that an object could appreciate in value or that an object could be sold at a profit in the secondary market, that expectation or profit could be retrospectively attributed to just about any collectible or any consumer good or any piece of art or any piece of music,” Torres said.

Source: theblock.co