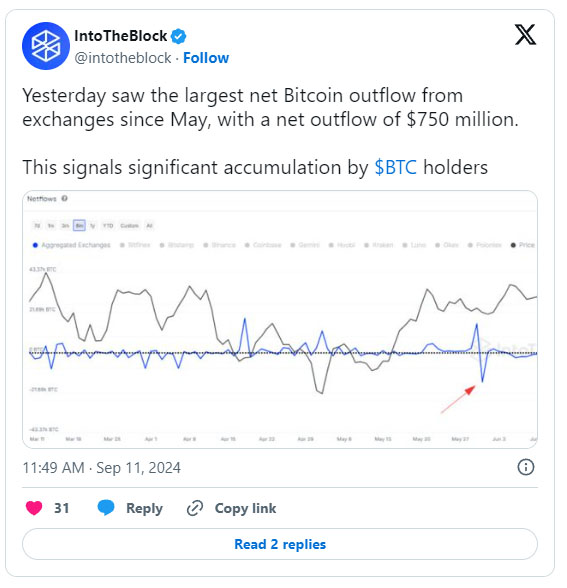

Bitcoin holders have moved around $750 million worth of the flagship cryptocurrency out of centralized exchanges in a single day this week, leading to largest net Bitcoin outflow since May.

That’s according to data shared by IntoTheBlock, which shows that the four-month peak in net Bitcoin outflows came on September 10, as the price of Bitcoin recovered to surpass the $57,000 mark. Bitcoin is now already above $58,000.

Historically, similar outflows have been followed by price increases as often a lower supply on exchanges can lead to a price rise if demand remains steady or rises.

For instance, a significant withdrawal in late May coincided with a rally that propelled Bitcoin’s price from just below $68,000 to $72,000 within days. Conversely, large inflows have often led to price declines, as evidenced by the crash in late July and early August, according to IntoTheBlock’s data.

The net outflows come at a time in which data from crypto analytics firm CryptoQuant has revealed a significant shift in the dynamics of Bitcoin ownership, showing that short-term holders, those who have held their bitcoin for 155 days or less, have been steadily reducing their positions since late May, indicating weakening demand for the cryptocurrency.

In contrast, long-term BTC holders appear to be accumulating their positions as short-term holders sell off their holdings. CryptoQuant’s data shows a notable trend over the past few months, as short-term holders have significantly reduced their positions, particularly in July and August.

This sell-off by short-term holders could lead to medium-term price appreciation and market stabilization, according to CryptoQuant contributor IT Tech, who wrote that the “data shows a clear capital flow from weak hands (STH) to strong hands (LTH), signaling market stability.”

Source: cryptoglobe.com