Bitcoin is giving hints that an upward BTC price phase is about to begin, as measured by two popular trading tools.

Bitcoin a reclaim of $60,000 into the Aug. 18 weekly close as “out of hours” BTC price action saw strength.

Ichimoku crossover leads bullish BTC price signals

Data from TradingView showed new local highs of $60,271 on the day.

Despite the absence of traditional market traders, BTC/USD slowly edged higher throughout the weekend, while price indicators hinted at continued upside to come.

Analyzing the Ichimoku cloud on daily timeframes, popular trader Titan of Crypto flagged a key bullish crossover, setting Bitcoin up for an upward run.

“BTC just closed a candle above Tenkan and is now eyeing a Kijun reclaim,” he wrote in part of accompanying commentary on X.

Titan of Crypto referred to the classic TK crossover, an event on an Ichimoku chart that traders look for as a sign of an imminent upside breakout.

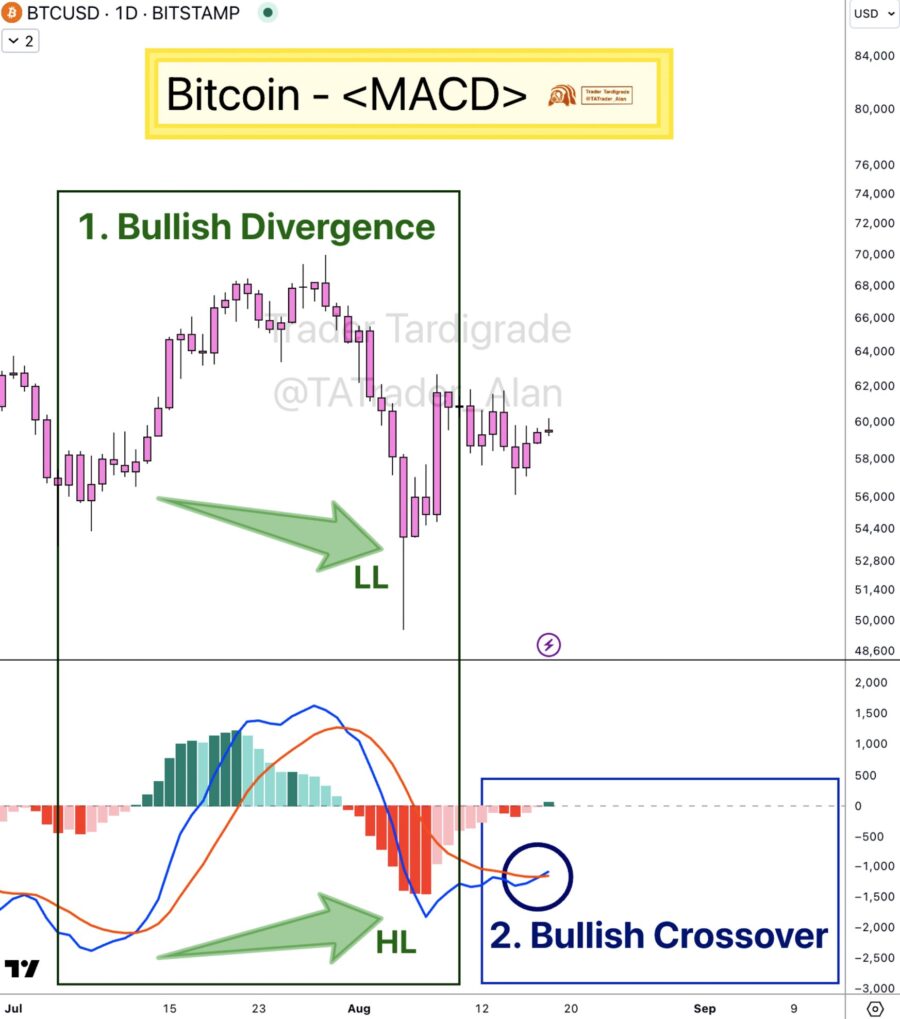

The post additionally noted a bullish cross for the moving average convergence/divergence (MACD) indicator, which measures the interplay between two moving averages to determine buy and sell points.

“$BTC has a very high chance of pumping again SOON,” fellow trader Alan Tardigrade concluded in his own post on the topic.

Bitcoin’s “parabolic” phase still in play

Continuing, popular trader and analyst Rekt Capital reiterated that $60,600 was now the ideal level for bulls to clinch at the weekly close.

In doing so, the price would win back its post-halving “reaccumulation range” lost during the snap trip to six-month lows earlier in August.

“It would also signal the end of its downside deviation bargain period below the ReAccumulation Range (orange circle),” Rekt Capital added alongside an explanatory chart.

A further post added a countdown to a more intense period of price growth, using past cycles as a guide.

“Bitcoin is ~125 days after the Halving. Bitcoin tends to breakout into the Parabolic Phase of the cycle some ~160 days after the Halving,” it stated, with Rekt Capital reiterating an existing theory from July.

Source: Cointelegraph