Equities and Crypto Both Drift Lower as Tariff Uncertainty Weighs on Traders

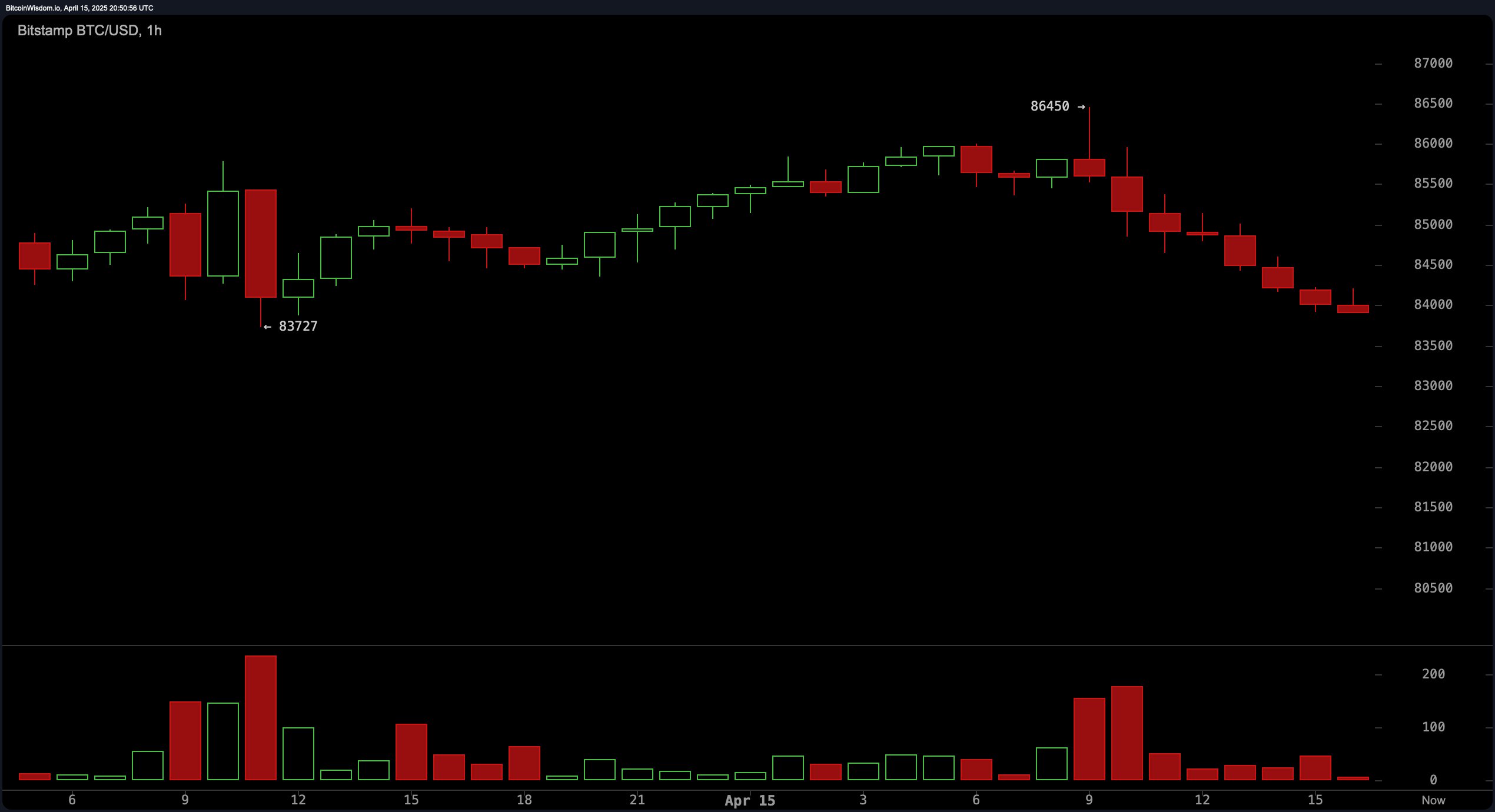

As of 4:50 p.m. EDT on Tuesday, Apr. 15, the global crypto market capitalization had contracted by 1.07% to $2.65 trillion. Bitcoin gave up approximately 0.8% after touching an intraday peak of $86,450 earlier in the day. Ethereum (ETH) followed suit, slipping 1.16%, while cardano (ADA) recorded the steepest drop among the top ten cryptocurrencies, falling 2.64% against the U.S. dollar.

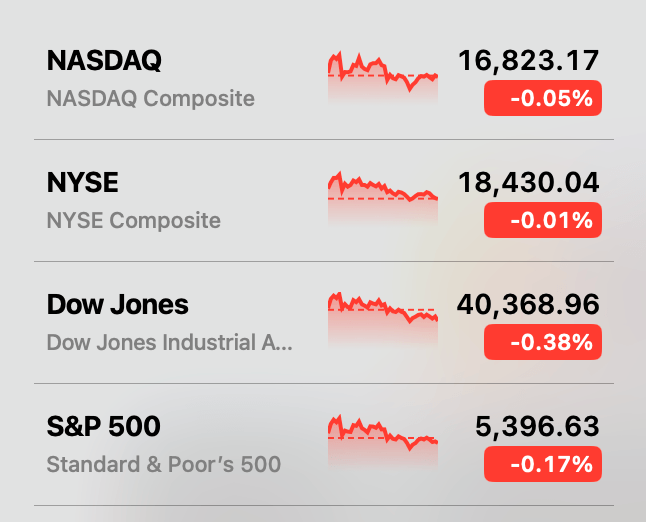

Stocks edged lower as key indices posted slight declines ranging from 0.05% to 0.38%. Quarterly reports from Citigroup and Bank of America were released, though both came accompanied by cautionary notes on the state of the U.S. economy. Bank of America CEO Brian Moynihan said, “There’s a lot that could potentially change given the uncertainty around the tariffs and other policies in the future path of the economy.”

In the crypto derivatives space, the downturn triggered liquidations totaling $176.72 million, according to figures from coinglass.com. Of that amount, approximately $105.86 million came from long positions, with BTC longs alone accounting for $18.65 million. MANTRA’s OM emerged as the day’s top performer, climbing 23% following the project’s weekend fallout.

As traders digest fresh data and liquidations unsettle speculative bets, the day’s contrasting gainers and decliners suggest a market still searching for conviction amid uncertainty. In Trump’s tariff era, volatility, it seems, remains the only constant for now.

Source:news.bitcoin.com