From Pause to Pressure: Trump’s Tariff Moves Fuel Speculation on Polymarket and Kalshi

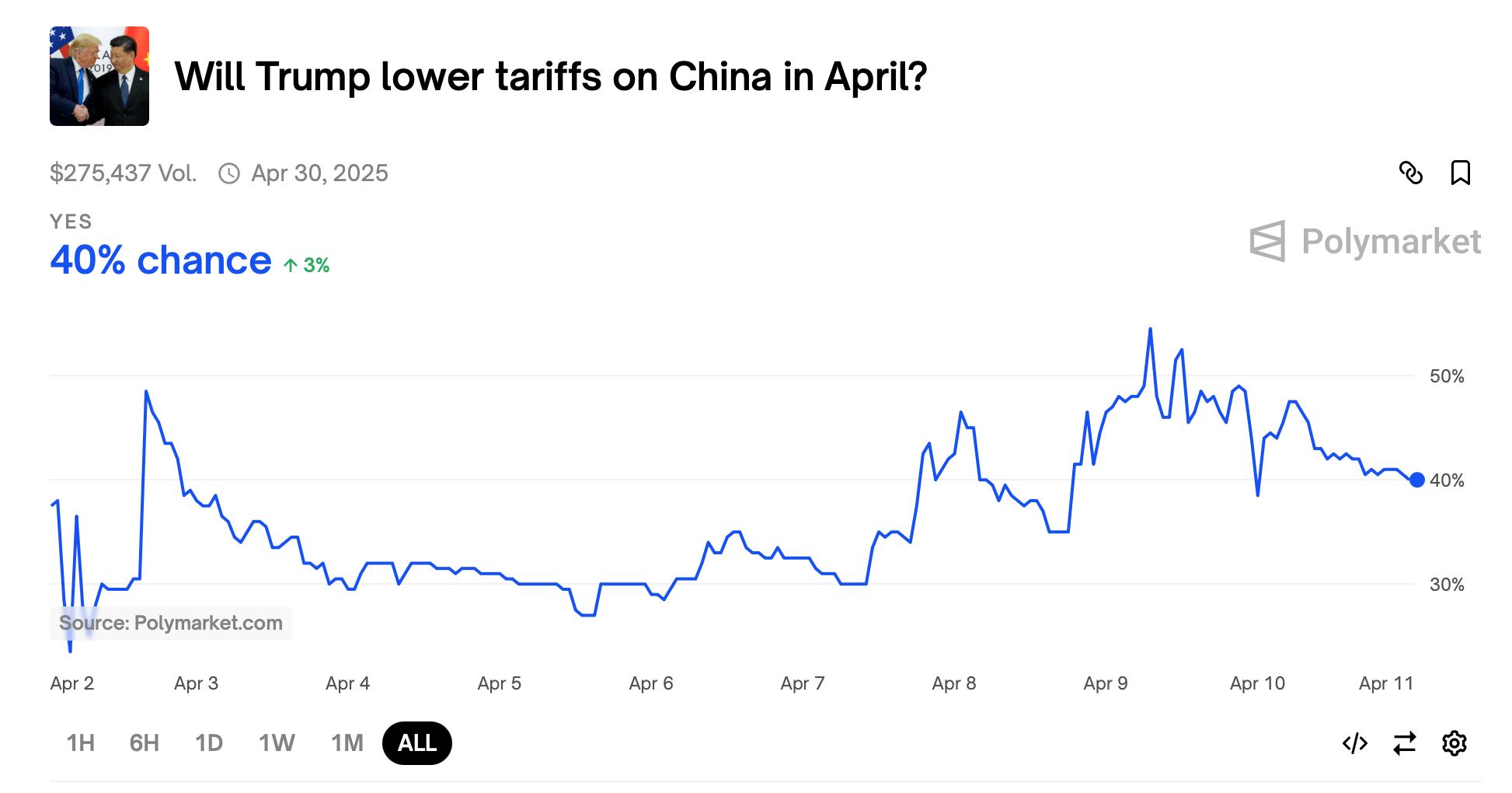

Participants are staking capital on the trajectory of Trump’s global tariff policy. When first unveiled, the plan included a 10% minimum rate worldwide, with steeper penalties for what he referred to as “major offenders.” On April 9, the administration suspended all tariffs above 10% for a 90-day period, with the exception of China—whose rate jumped to 125%, then climbed again to 145% by Friday.

Kalshi also hosts a suite of wagers tracking Trump’s tariff decisions. One titled “When will Trump end his tariffs against China?” offers only a 3% chance of a rollback by May 2025. The odds rise to 18% for June, and hit 28% by December. Kalshi users are also placing bets on the possibility of Trump introducing export tariffs.

That specific contract, touching on export tariffs, currently shows a 15% chance of materializing. Trump’s trade pronouncements continue to command the focus of financial markets, having already driven historic stock sell-offs, wiped out trillions in market capitalization, and stirred concerns about escalating trade conflicts, inflationary pressure, and economic downturns.

Source:news.bitcoin.com