Bitcoin (BTC) may have a severe correction if one major support level fails to hold up, according to digital asset analytics firm Glassnode.

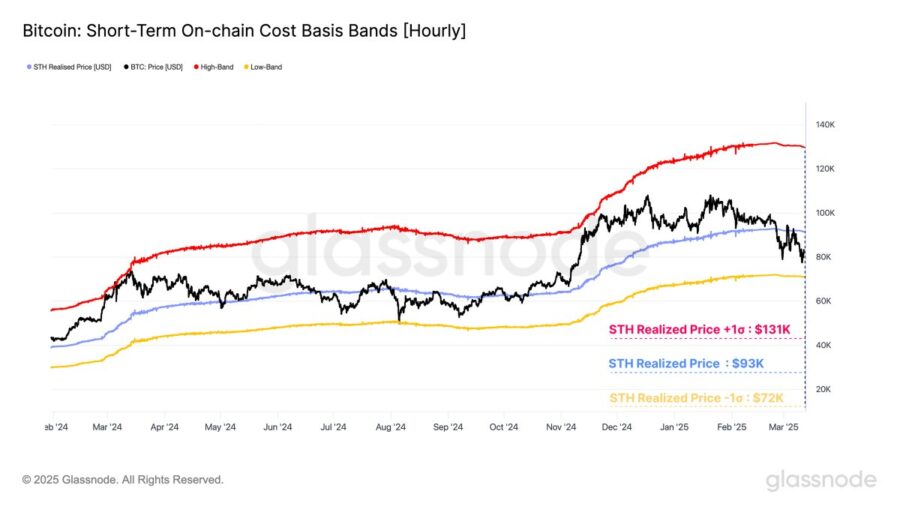

Glassnode says that short-term holders – or those who acquired their coins in the past 155 days – may sell off if Bitcoin falls below $72,000 based on the realized price metric, sending the flagship crypto asset much lower.

The realized price metric is the average price of Bitcoin in circulation calculated based on the price at which they were last moved.

“Short-term holder realized price sits at $93,000, with ±1 sigma bands at $131,000 and $72,000. Price remains within this range, but has nearly tested the lower band. A break below the $72,000 threshold could challenge short-term conviction and trigger further downside.”

Glassnode also says that key price levels identified using Bitcoin’s day moving averages (DMAs) indicate the flagship crypto asset is at risk of a downturn.

“Bitcoin is now below both the 111 DMA ($93,000) and 200 DMA ($87,000), having recently tested 365 DMA at $76,000. These long-term moving averages have historically acted as key support zones. A breakdown here may signal a deeper structural shift in market sentiment.”

Lastly, Glassnode says Bitcoin may dip to as low as $65,000, which may be seen as a buying opportunity by investors, based on the true market mean metric, a representative cost basis model for all coins acquired on secondary markets.

Glassnode also uses the active realized price metric, which uses the realized price but excludes the supply that Glassnode determined is unlikely to return into circulation, to identify $71,000 as another possible support level to the downside.

“BTC True Market Mean at $65,000 and the Active Realized Price at $71,000 mark deeper support levels. These levels sit above a low-liquidity zone, making them critical to defend. A drop into this range may catalyze high volatility and attract long-term buyers.”

Bitcoin is trading for $78,888 at time of writing, up 1.8% in the last 24 hours.

Source: dailyhodl.com