Bitcoin’s Sunday Decline Triggers Deep Losses Across Digital Assets

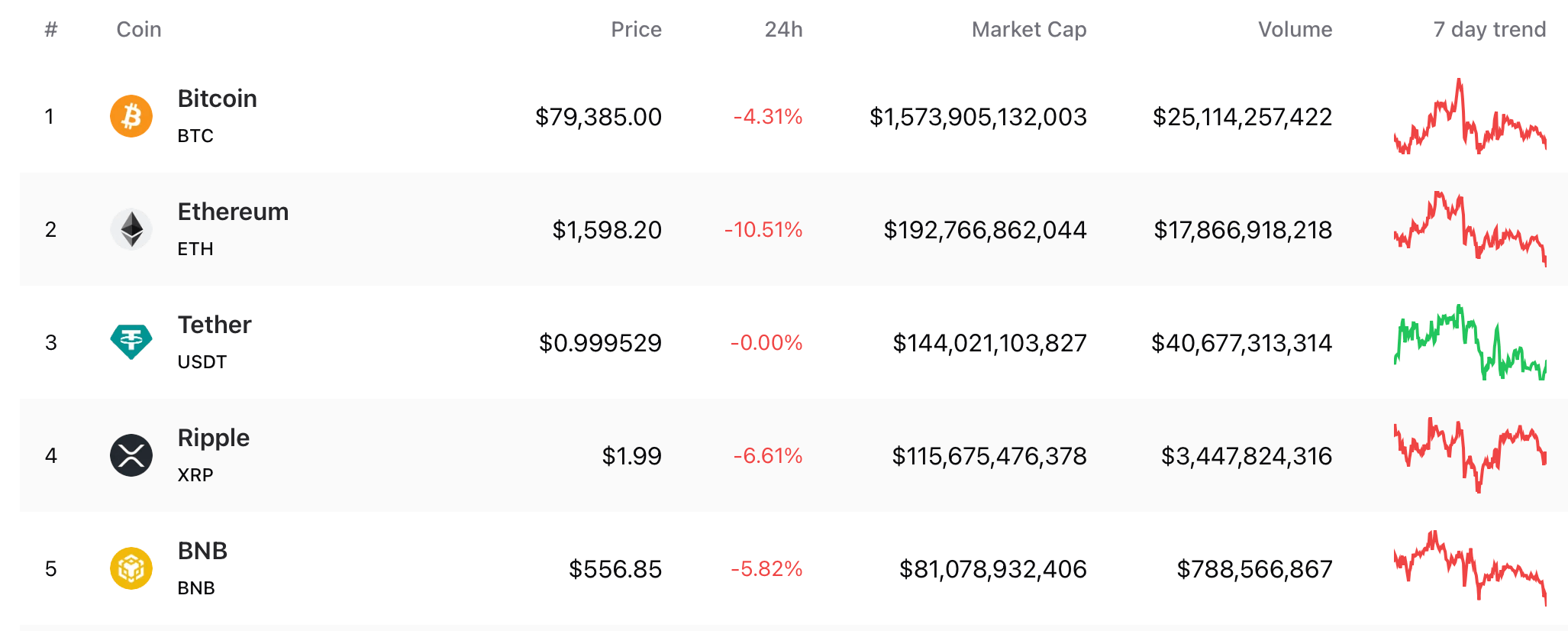

By Sunday evening, just before 5 p.m. ET, bitcoin ( BTC) was changing hands at $79,385 per coin, having earlier dipped to an intraday low of $78,639. As of this writing, BTC has declined 4.3% against the U.S. dollar and is showing a 30-day contraction of 9.3%. The evening’s most active trading pair remains USDT, followed in volume by USD, USDC, FDUSD, EUR, and KRW.

Bitcoin’s downturn has sent tremors through the broader digital asset sector, as altcoins follow suit with heavy declines. Ethereum ( ETH) endured a 10.5% drop today, while XRP is down 6.6%. BNB slipped by 5.8%, and SOL has relinquished approximately 9.5% of its value in the past 24 hours. Similarly, DOGE mirrored SOL’s retreat, losing 9.5% as well. Since Friday, the crypto market has experienced a staggering $160 billion contraction, the bulk of which unfolded on Sunday.

Elsewhere in the sector, several tokens registered double-digit pullbacks. TAO dropped 14.7% today, WLD fell by 13.7%, and OP retreated 13% against the greenback. At 1:45 p.m. ET on Sunday, crypto derivatives markets recorded $252.79 million in liquidations. That figure soared to a whopping $603.08 million by 4:30 p.m. as BTC fell beneath the $80,000 line. Roughly $165 million of those wiped-out positions were BTC long positions, with an additional $148 million in ETH long bets facing similar fates.

Sunday’s volatility laid bare the delicate equilibrium within crypto markets, as bitcoin’s decline rippled through altcoins and derivatives with swift consequence. Widespread liquidations exposed the fragility of leveraged positions, intensifying the extent of losses as prices sank beneath $80,000 and even $79,000. These sudden reversals challenge investor conviction, compelling a fresh evaluation of risk in the face of unstable valuations.

At precisely 5 p.m. ET on Sunday, BTC was trading below the $79,000 mark at $78,770 per unit.

Source:news.bitcoin.com