Bitcoin ETFs Secure Another Week of Inflows as Ether ETFs Weekly Outflow Streak Reaches Fifth Week

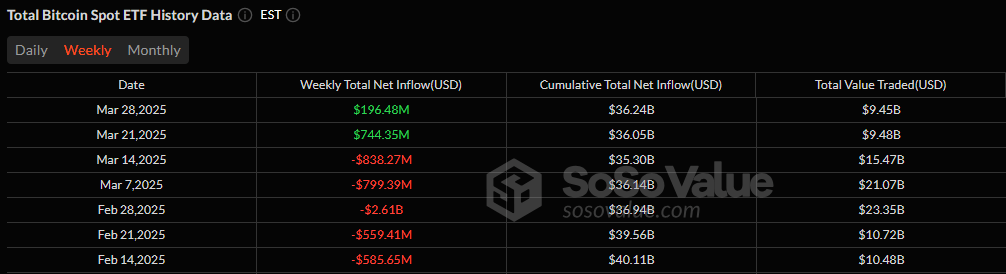

The tides have turned for bitcoin ETFs, which wrapped up their second consecutive week of net inflows, adding $196.48 million. The overall trend remained positive despite a sharp $93.16 million outflow on Friday, Mar. 28.

The highlight of the week came on Wednesday, Mar. 26, when bitcoin ETFs saw their biggest single-day inflow of $89.57 million, signaling continued institutional interest. Blackrock’s IBIT dominated the week with a $171.95 million inflow, followed by Fidelity’s FBTC, which added $86.84 million. Vaneck’s HODL contributed a modest $5 million.

However, not all funds shared in the gains. Ark 21shares’ ARKB saw the largest weekly outflow at $40.97 million, while Wisdomtree’s BTCW, Bitwise’s BITB, and Invesco’s BTCO lost $10.22 million, $9.15 million, and $6.95 million, respectively.

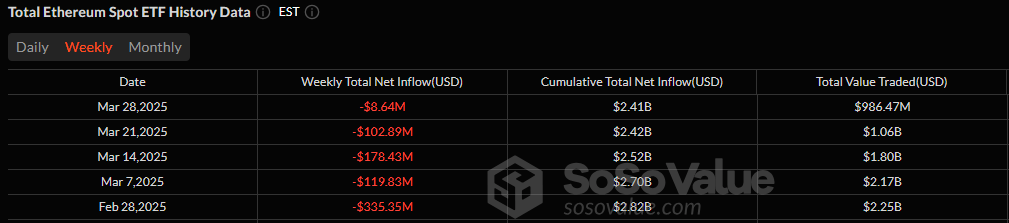

On the other hand, ether ETFs continued their struggle, marking their fifth consecutive week of outflows. Investors pulled $8.64 million over the week, with the most significant outflow occurring on Wednesday ($5.89 million).

Grayscale’s Mini ETH Trust led the losses with a $6.66 million exit, followed by Fidelity’s FETH ($3 million), Vaneck’s ETHV ($2.21 million), and Invesco’s QETH ($1.45 million). The lone bright spot was Grayscale’s ETHE, which bucked the trend with a $4.68 million inflow.

Source:news.bitcoin.com