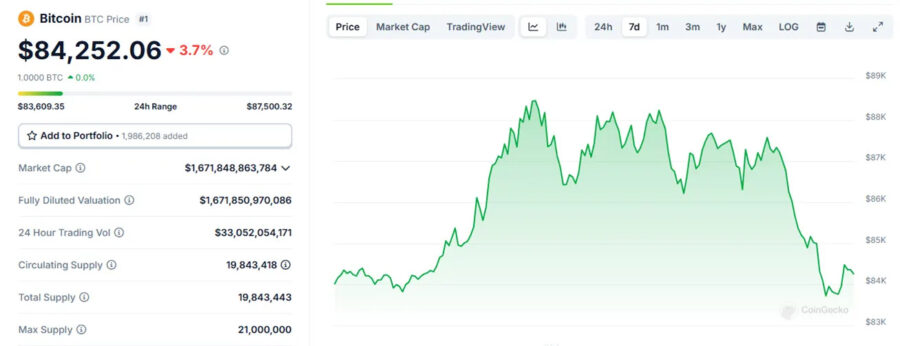

29-3-2025 – The cryptocurrency market suffered a bruising setback on Friday, shattering earlier optimism for a sustained recovery. A widespread sell-off stripped away nearly all the gains notched up earlier in the week, leaving investors reeling. Bitcoin (BTC), which had been tantalisingly close to $88,000 just a day prior, plummeted to $83,800, marking a 3.8% decline in the past 24 hours. The broader market felt the sting too, with the CoinDesk 20 Index—a key barometer of crypto performance—slumping by 5.7%. Among the hardest hit were Avalanche (AVAX), Polygon (POL), Near (NEAR), and Uniswap (UNI), each nursing losses nearing 10% over the same period. TradingView figures reveal the carnage erased $115 billion from the total value of cryptocurrencies in a single day.

The downturn wasn’t confined to digital assets. Across the Atlantic, U.S. stock markets mirrored the gloom, triggered by disappointing economic data. The S&P 500 shed 2%, while the tech-laden Nasdaq slumped 2.8%. Crypto-related equities bore the brunt as well: MicroStrategy (MSTR), the biggest corporate holder of Bitcoin, saw its shares dive 10%, and Coinbase (COIN), a leading crypto exchange, closed 7.7% lower. The trigger for this unease came from the latest Personal Consumption Expenditures (PCE) inflation report, unveiled earlier that day. It pegged annual inflation at 2.5%, with core inflation—a measure stripping out volatile food and energy prices—edging up to 2.8%, just above forecasts. Consumer spending ticked up a modest 0.4%, but when adjusted for inflation, growth was negligible, hinting at choppy waters ahead for the U.S. economy.

Adding to the jitters, the Federal Reserve Bank of Atlanta’s GDPNow model now forecasts a 2.8% contraction for the U.S. economy in the first quarter of 2025—adjusted to 0.5% when accounting for gold imports and exports. This has stoked fears of stagflation, a toxic mix of stagnant growth and rising prices. Next week’s rollout of sweeping U.S. tariffs, dubbed “Liberation Day” by the Trump administration and set for April 2, has only deepened investor unease across both traditional and crypto markets.

Ethereum’s ether (ETH) wasn’t spared either, sliding over 6% and hitting its lowest price relative to Bitcoin since May 2020. The bearish mood was underscored by a stark contrast in fund flows: spot ETH exchange-traded funds have seen no net inflows since early March, while Bitcoin-focused ETFs raked in over $1 billion in the past fortnight, per Farside Investors data. Yet, amidst the gloom, some analysts spy a silver lining. Bitcoin’s drop to around $84,000-$85,000 might simply reflect it filling a price gap from the Chicago Mercantile Exchange (CME) futures market, a pattern it has followed historically, according to CoinDesk’s senior analyst James Van Straten.

Joel Kruger, a market strategist at LMAX Group, struck a cautiously hopeful note. While acknowledging the current correction, he pointed to encouraging signs—such as crypto-friendly U.S. policies and growing involvement from traditional finance giants—as potential tailwinds for the sector later this year. “Any further dips should find solid footing in the $70,000-$75,000 range,” he suggested. Still, with Bitcoin’s fortunes lately tied to the Nasdaq’s ups and downs, another tumble in U.S. equities could drag the crypto market lower. Whether this is a fleeting dip or the start of a deeper slide remains anyone’s guess. “It’s too early to say if 2025 has hit its nadir,” Kruger cautioned, leaving investors to ponder what lies ahead.

Source: cointrackdaily.com