-

- A Cardano price breakout above $0.7 could signal a move to the upside, while breakout at $0.65 may lead to a drop toward $0.58.

-

- Cardano market cap dominance has risen by 78.23% since 2024 as its social sentiment hits a 4-month high.

-

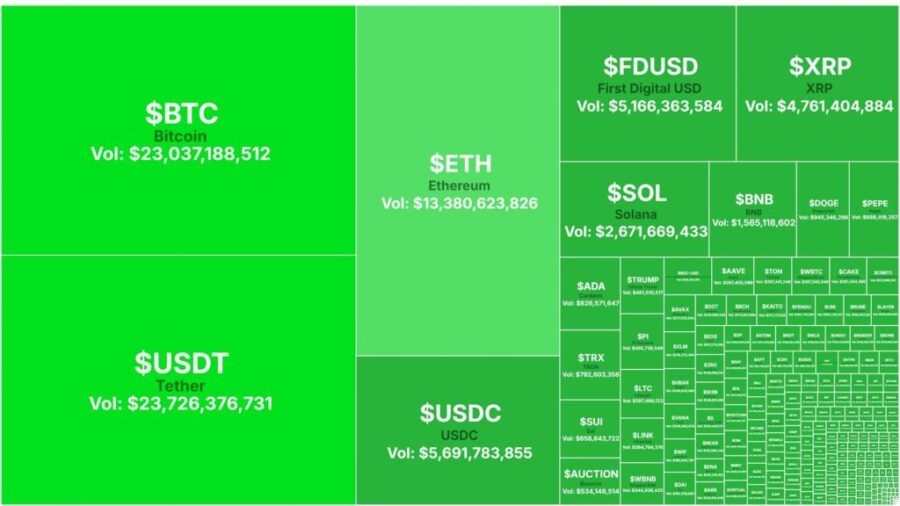

- ADA among top market volume maps in the last 24 hours.

Cardano price rise above $0.777 is an indication of a bullish breakout, which could drive the market upward.

Such a point is vital for investors because it tends to draw significant buying pressure.

If ADA falls beneath key demand zone $0.65 it signals a bearish trend, which might lead Cardano price to move down to $0.58.

A break of this essential support level would likely cause it to tumble even further downward.

It is crucial for traders to monitor these levels since rising trading volume would confirm which direction the breakout will take.

ADA’s future direction strongly depends on market sentiment and general market trends.

Cardano Market Cap Dominance Rises

Other analysis of Cardano price showed the altcoin faced a remarkable 78.23% surge in its dominance, which began in late 2024. ETH together with Solana experienced a 34% decrease in their market dominance.

Cardano market share continues to rise as other primary alternative coins experience difficulties.

As of press time ADA maintained its first place at a fluctuating rate of 1% while recording a recent dominance figure of 0.93%.

The continuous momentum indicated that ADA may solidify its position among other cryptocurrencies in the market.

The market demands close monitoring because Bitcoin market movements together with general crypto trends will affect ADA’s dominance positioning.

The ADA expanding ecosystem demonstrated through its dominance that it may experience sustained growth going forward. Investors who want to benefit from market trends can use current industry changes to develop strategic decisions.

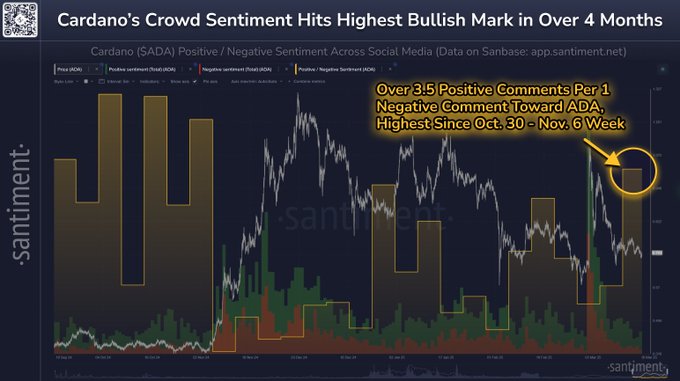

Cardano Price Social Sentiment at 4-month High

The public sentiment toward Cardano’s social sentiment reached a high mark, which has not been seen in four months.

ADA’s present ratio of 3.5 positive to negative comments about ADA stands as its highest since October 30 to November 6 week this year.

Positive sentiment continues to rise because the SEC confirmed ADA operates as “smart contracts for government services.”

Evidence shows that price movements typically relate to social market sentiments.

Cardano prcie signs of sustaining its upward movement could possibly draw larger interest from retail investors together with institutional investors.

The bright future outlook of Cardano depends on its solid community backing and continuous platform improvements.

Top Market Volume Maps

Cardano also occupies one of the primary positions among trading cryptocurrencies based on daily market activity.

The market keeps showing keen interest in Cardano price because its recorded trading volume reaches $826.57 Million.

The cryptocurrency exchange volume indicates Bitcoin (BTC) produces $23.03 Billion while Tether (USDT) generates $23.72 Billion and Ethereum (ETH) achieves $13.38 Billion.

Both Solana and XRP achieved daily trading volumes of $2.67 Billion and $4.76 Billion.

First Digital USD ranks among the prominent assets with $5.16 Billion while Binance Coin stands at $1.56 Billion.

Cardano price continues to occupy an established market position because of its sustained high trading activity.

Enhanced market momentum appears likely to spur additional price changes that will attract an increased number of traders.

Source: thecoinrepublic.com