Bitwise investment chief Matt Hougan says Trump’s crypto reserve announcement should be seen as bullish and that the market is “misreading things.”

Despite including several large-market cap altcoins, US President Donald Trump’s planned crypto reserve will eventually be made up almost “entirely of Bitcoin,” says Bitwise chief investment officer Matt Hougan.

“Market participants have soured on the announcement because the proposed reserve holds more than Bitcoin,” Hougan explained in a March 5 market note. “The inclusion of small-cap assets in the announcement unnecessarily complicated matters.”

On March 2, Trump initially said the stash would include Solana, XRP and Cardano, later adding that Bitcoin and Ether would be “the heart” of the reserve. Hougan said:

“After the dust settles, I suspect the final reserve will be nearly entirely Bitcoin, and it will be larger than people think.”

Bitcoin’s price initially jumped on the news of its inclusion in the slated reserve, but it later sunk to below $83,000 and has only recovered to above $90,000 over the last day in part due to Trump delaying auto parts tariffs on Canada and Mexico.

Trump’s move away from a Bitcoin-only reserve has concerned some crypto commentators who said Bitcoin is the only cryptocurrency suited for inclusion in the reserve, with Coinbase CEO Brian Armstrong arguing it’s “a successor to gold.”

“The inclusion of speculative assets like Cardano feels more calculating than strategic,” Hougan said. He added that “despite the flawed rollout,” he thinks the market “is misreading things,” adding:

“In the end, this is bullish.”

Hougan said that, as is the case with tariffs, Trump’s initial proposals are “rarely his final,” and input on the reserve from industry bigwigs at the upcoming White House crypto summit could see its makeup change.

Commerce Secretary Howard Lutnick has hinted that Bitcoin could receive a special status in the reserve and “other crypto tokens, I think, will be treated differently — positively, but differently.”

Hougan said there’s a small, more unlikely, possibility that pushback on the idea will see the reserve scrapped or limited to assets the government has already seized.

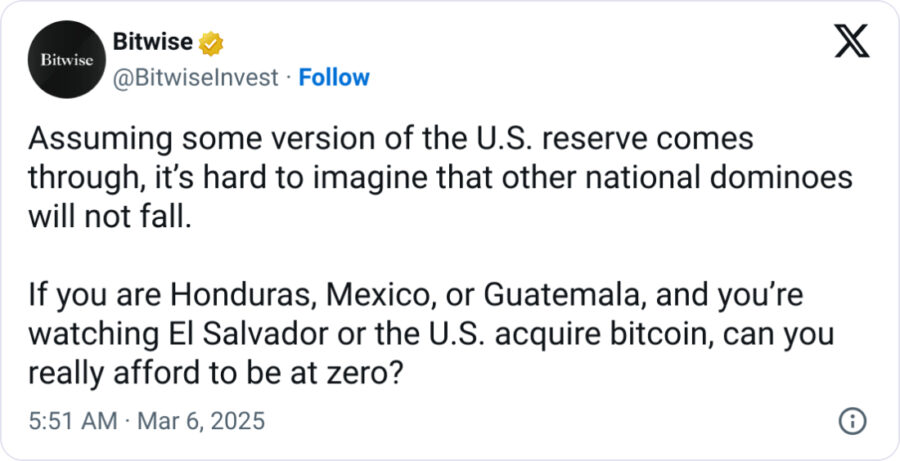

If the US makes a crypto reserve, it’ll be more likely that other countries will look at wanting their own slice of Bitcoin, he added.

It’s also unlikely that the US will sell any crypto it buys, even if a Democrat takes Trump’s place after he’s gone. Hougan said. Any crypto “will be held for a very long time,” like the country’s gold reserves, he added.

“Democratic leaders won’t want to alienate voters at little benefit to themselves,” he said.

“There are a significant number of people who love crypto and a relatively small number who hate it,” Hougan added. “We learned this in the last election, where the GOP’s courtship of crypto gained it many votes while Democratic hostility gained few.”

Hougan said the market’s initial bullishness “strikes me as the right one […] I think the market will eventually realize that.”

Source: cointelegraph.com