- The strength of Bitcoin above the $92k support during the recent, tumultuous weeks was encouraging for the bulls.

- The falling sentiment was a reflection of the steady losses across the rest of the market as well as online engagement.

The long-term Bitcoin outlook remained bullish as the price was still within a range formation. Yet, Tether metrics showed that stablecoin inflows to exchange have dried up.

Traders and investors were hesitant to enter the market, an understandable reaction to the price action of the past few weeks.

The Bitcoin buy/sell pressure delta showed a decline in buying pressure over the past two months.

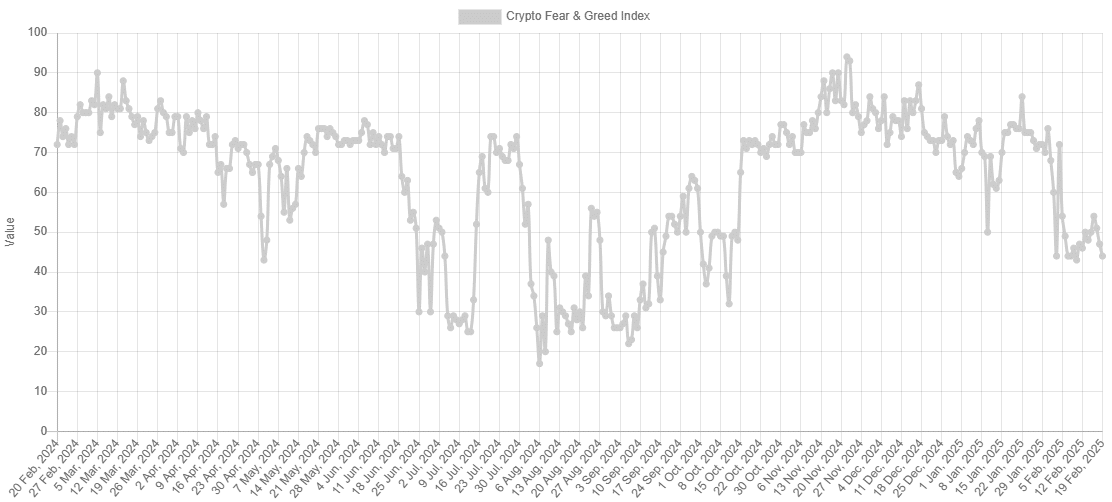

The market sentiment has also weakened, reaching September and October levels after failing to defend the November gains.

Bitcoin Fear and Greed Index falls to 4-month lows

The Bitcoin Fear and Greed Index uses various factors such as price action, volatility, social media engagement, and BTC dominance to gauge sentiment.

The strong gains following the U.S. Presidential election saw the sentiment soar higher.

Previously, the March 2024 rally saw the index reach values of 80 and higher consistently. This began to shift in late April. Similarly, the November sentiment uptick began to taper off just over a month later.

This descent has not yet fully halted.

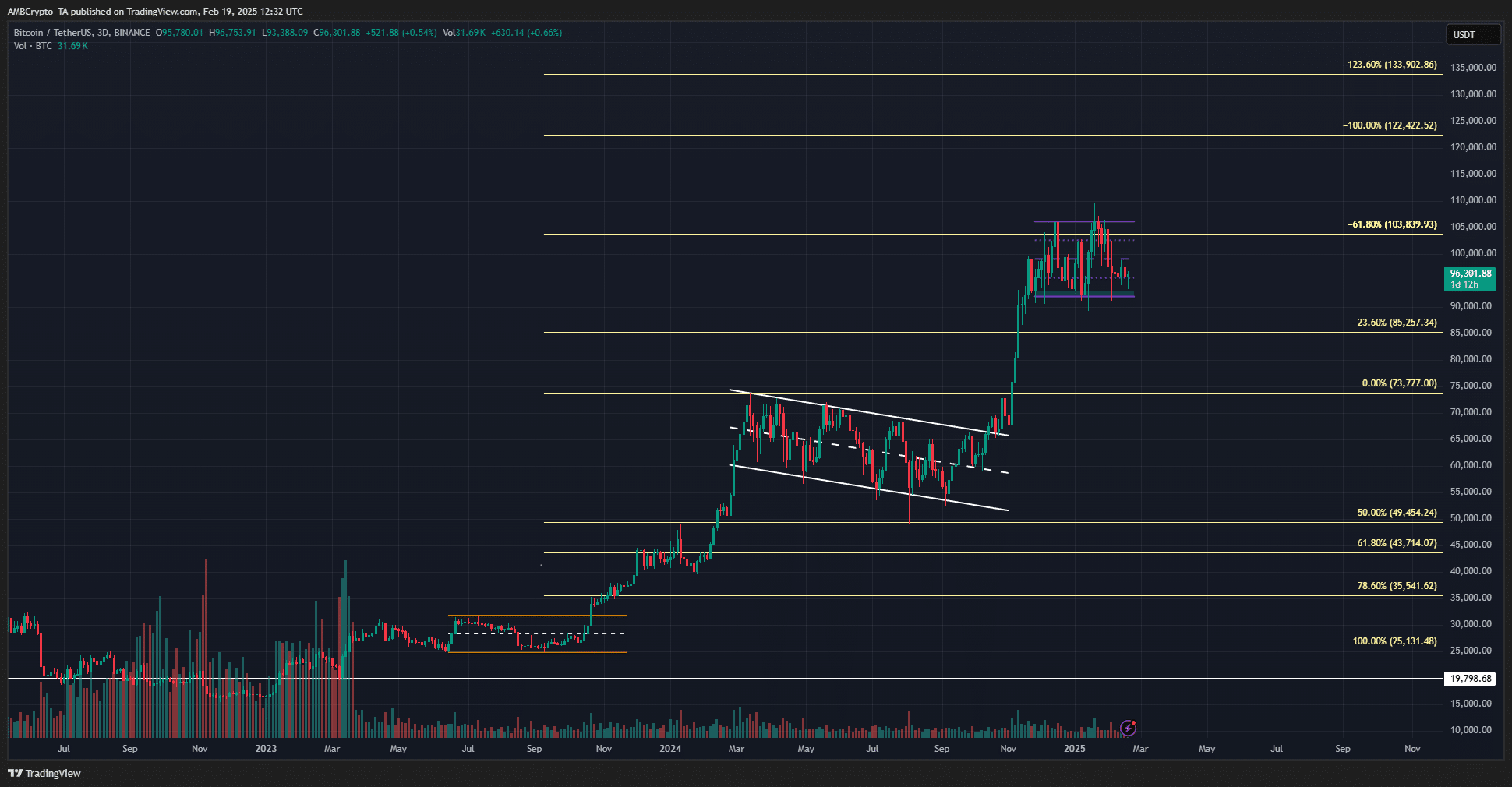

Source: BTC/USDT on TradingViewThe weekly chart showed that BTC has a firmly bullish swing structure despite the erratic sentiment swings.

Regardless of the fearful macroeconomic outlook in the U.S. markets, and the tariff-related volatility in certain markets, Bitcoin has defended the $92k range lows.

It could dip to $88k-$90k sometime in the coming weeks, but this sweep of the range lows would present a buying opportunity. HODLers must not give in to panic — at least, not yet.

BTC did not consolidate within a falling channel for seven months in 2024, only to make a 60% rally and then call it quits.

Or perhaps it did, it is hard to be sure- but most of the on-chain metrics do not show a top is in yet.

Source: ambcrypto.com