- Bitcoin saw 47K BTC outflows, but the price remained somewhat stable on the charts

- Exchange reserves have continued to decline across the market

Bitcoin recently saw a significant outflow of 47,000 BTC, a movement that has sparked debate on whether it represents a true supply shock or a routine internal transaction. Historically, large outflows have been associated with long-term accumulation, reducing BTC’s liquid supply and potentially setting the stage for bullish momentum.

However, this latest move requires a closer look at on-chain data and price action.

Analyzing Bitcoin exchange reserves – Is accumulation in play?

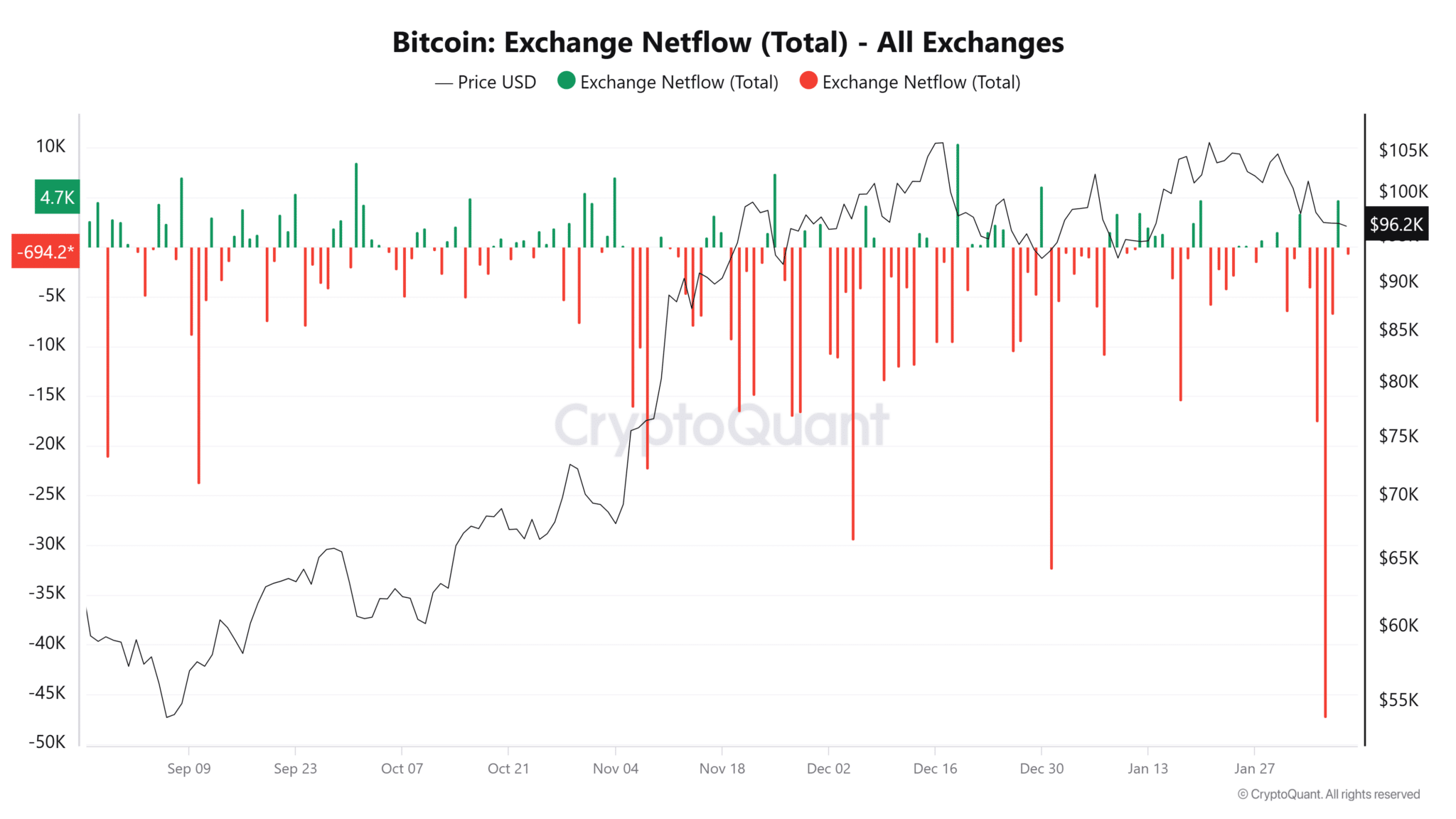

An analysis of Bitcoin‘s netflows showed that it has been seeing significant outflows, before the spike it witnessed a few days ago. BTC outflows spiked to over 47,000 BTC, making it the largest such move since 2022.

The significance of these outflows led to talks about a supply shock. However, this alone did not quite confirm a supply shock.

Also, the Bitcoin Exchange Reserve chart revealed a sustained decline in BTC held across exchanges, dropping from over 3 million BTC in mid-2024 to around 2.45 million BTC in February 2025.

A shrinking exchange balance typically means investors are moving BTC to private wallets for long-term holding, reducing the supply available for immediate sale.

How did Bitcoin’s price react?

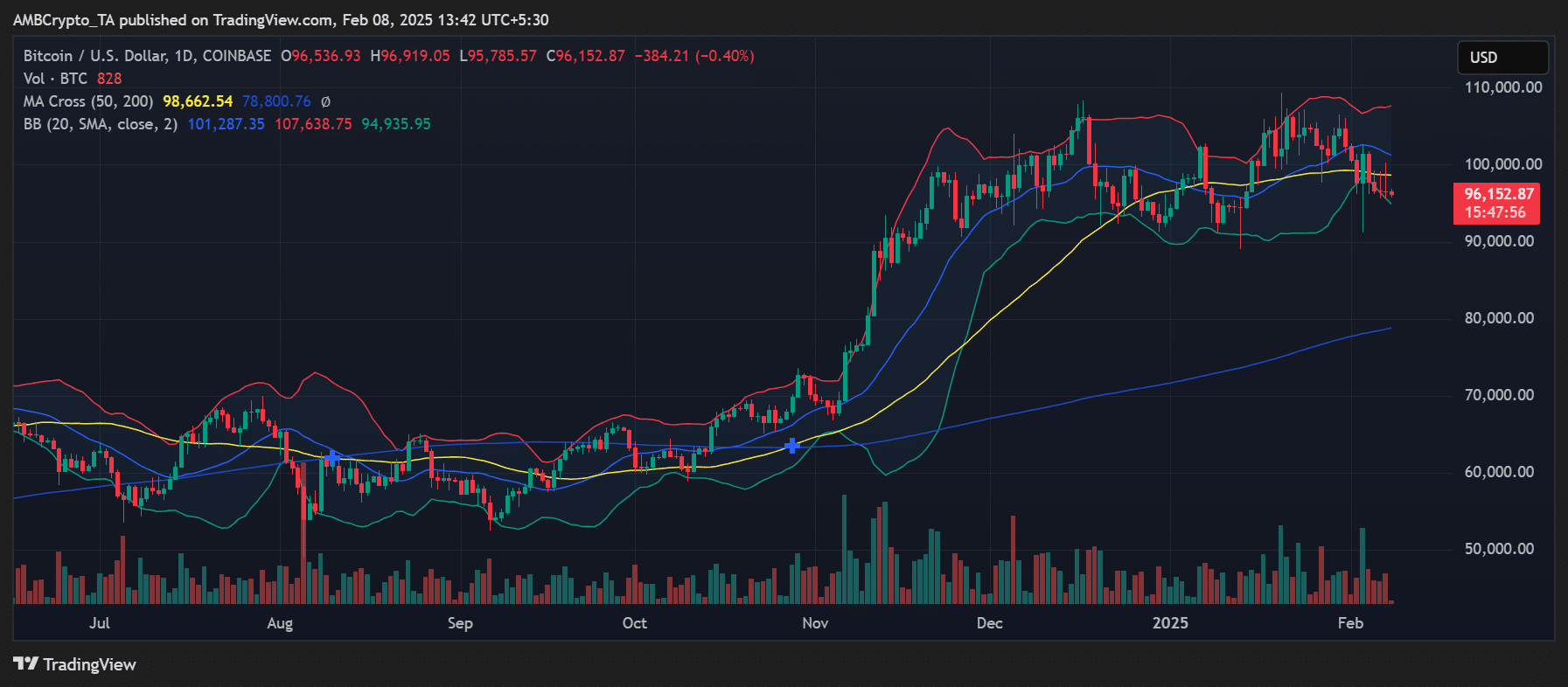

Following the outflows, Bitcoin’s price remained stable around $96,152 – A sign that the immediate market impact was minimal.

The Bollinger Bands indicated moderate volatility, with the price consolidating between $94,935 and $107,638. The 50-day moving average sat at $98,662, acting as a near-term resistance level.

While major outflows can indicate accumulation, a lack of strong price reaction means that this movement was not perceived as a market-altering event. At least in the short term.

Futures market underlines speculation

Glassnode’s Futures Open Interest chart revealed a steady increase in speculative positioning in January, with Open Interest nearing $60 billion.

Rising Open Interest and significant exchange outflows often mean that traders are betting on an upcoming supply squeeze. At the time of writing, the OI had a reading of around $44 billion.

However, if funding rates turn excessively positive, it could indicate that the market is over-leveraged. This could make Bitcoin susceptible to liquidation-driven pullbacks.

Supply shock or routine move?

While the 47K BTC outflows seemed to align with a broader trend of declining exchange reserves, its immediate market impact has been muted.

Several factors, including a lack of a sharp price movement and the potential for internal wallet reshuffling, suggest that this was not an immediate supply shock. Instead, a part of a long-term accumulation trend.

That being said, if Bitcoin withdrawals and whale activity continue like this, a supply squeeze could emerge in the coming months. The trend will gradually exert upward pressure on Bitcoin’s price.

Source: ambcrypto.com