Regulatory Gap

Regulatory Gap

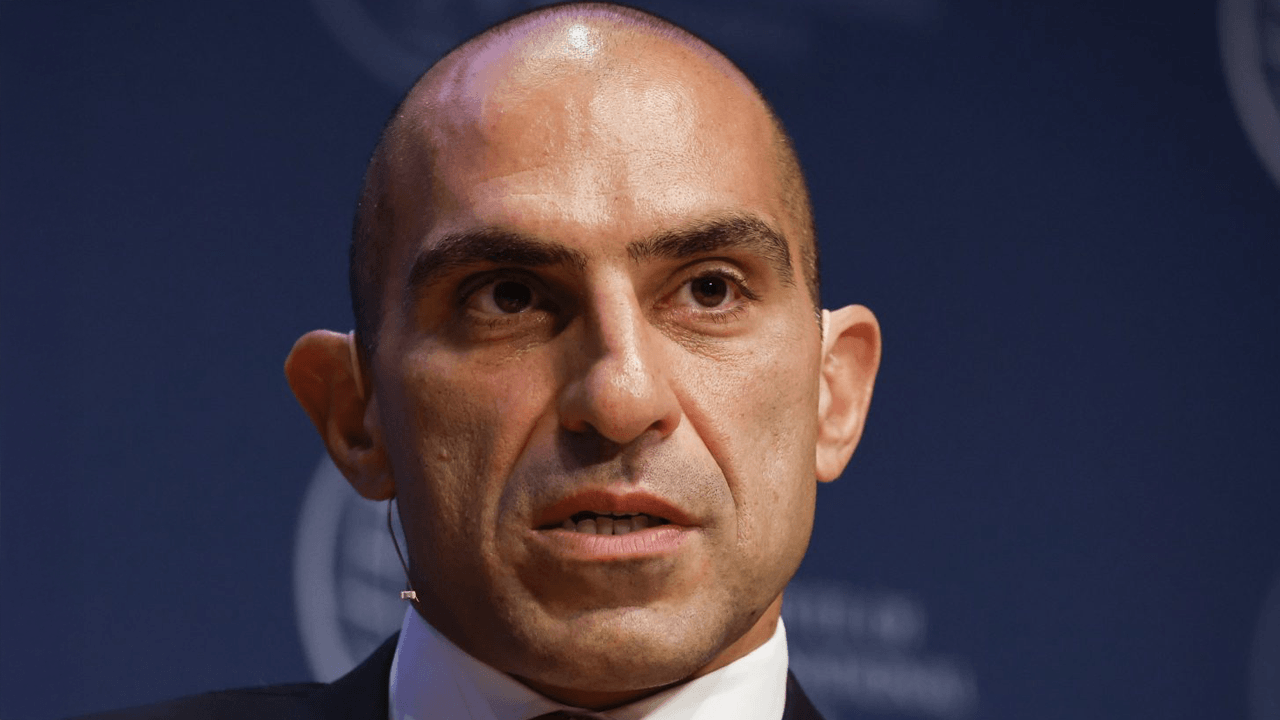

The outgoing chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, has lamented what he termed the insufficient regulation of cryptocurrencies in the United States. Behnam argued that the U.S. needs “comprehensive, strong regulation” to oversee cryptocurrencies, especially now that they are being adopted by more mainstream organizations.

In his remarks published in the Financial Times, Behnam, who is set to leave his position on Jan. 20, also reiterated his belief that the CFTC is better placed than any other agency to oversee digital assets. He added that filling the regulatory gap is especially important as more and more traditional financial institutions are embracing cryptocurrencies.

“You still have a large swath of the digital asset space unregulated in the US regulatory system and it’s important — given the adoption we’ve seen by some traditional financial institutions, the huge demand for these products by both the retail and institutional investors — that we fill this gap,” is quoted as saying.

During Behnam’s tenure as chairman, the CFTC successfully argued that Binance was operating illegally in the United States. The leading crypto exchange was slapped with a $4.3 billion fine, one of the largest in the CFTC’s history, for this infraction.

In his interview with the Financial Times, the departing CFTC chair again expressed strong concern about platforms that enable users to bet on political events. As reported by Bitcoin.com News and other cryptocurrency media, the CFTC previously fined the popular prediction market Polymarket for providing its services without registering as a swap execution facility (SEF). Additionally, Behnam’s agency also faced questions from U.S. politicians who feared that prediction markets would eventually be used to influence elections.

Behnam, meanwhile, urged his successor to bring a renewed focus on such platforms “so that we have more clear-cut lines of what we view as permissible and impermissible.”

Source:news.bitcoin.com