From Predictable Pasts to Revolutionary Futures

Although bitcoin has ridden through numerous rollercoasters of highs and lows, what if we’re entering an era of hyperbitcoinization where countries start stashing BTC in their reserves? Could this mean that the current cycle won’t crash as hard as those epic bull runs we’ve seen before? That’s the hot topic that bubbled up on the Reddit forum r/bitcoin this weekend. In the thread, the Redditor contends that a skyrocketing demand for bitcoin—fueled by big players like exchange-traded funds (ETFs), Microstrategy, alongside other companies and whispers of government interest—vastly exceeds the rate at which new bitcoins are minted.

Consequently, the Redditor proposes that the conventional four-year halving cycle might not hold its predictive charm anymore, as the surge in demand has taken center stage, overshadowing any impact from future supply reductions. The post sparked a flurry of responses to the idea and question that was floated, and the top comment from a Redditor named “Denfaina” racked up 270 upvotes with the declaration, “Cycle is cancelled, hyperbitcoinization on the roll.” Essentially, hyperbitcoinization envisions a world where bitcoin reigns supreme, dethroning fiat currencies as the go-to for exchange, value storage, and accounting.

“To answer your question,” Denfaina added. “It seems like an overwhelming portion of people have a time horizon (how far ahead one considers before taking action) too short or too focused on the past history to comprehend the upcoming wave of revolution. If you look at the past, revolutions that seem obvious have been called a scam or a passing wave before becoming the mainstream (e.g., the Internet).”

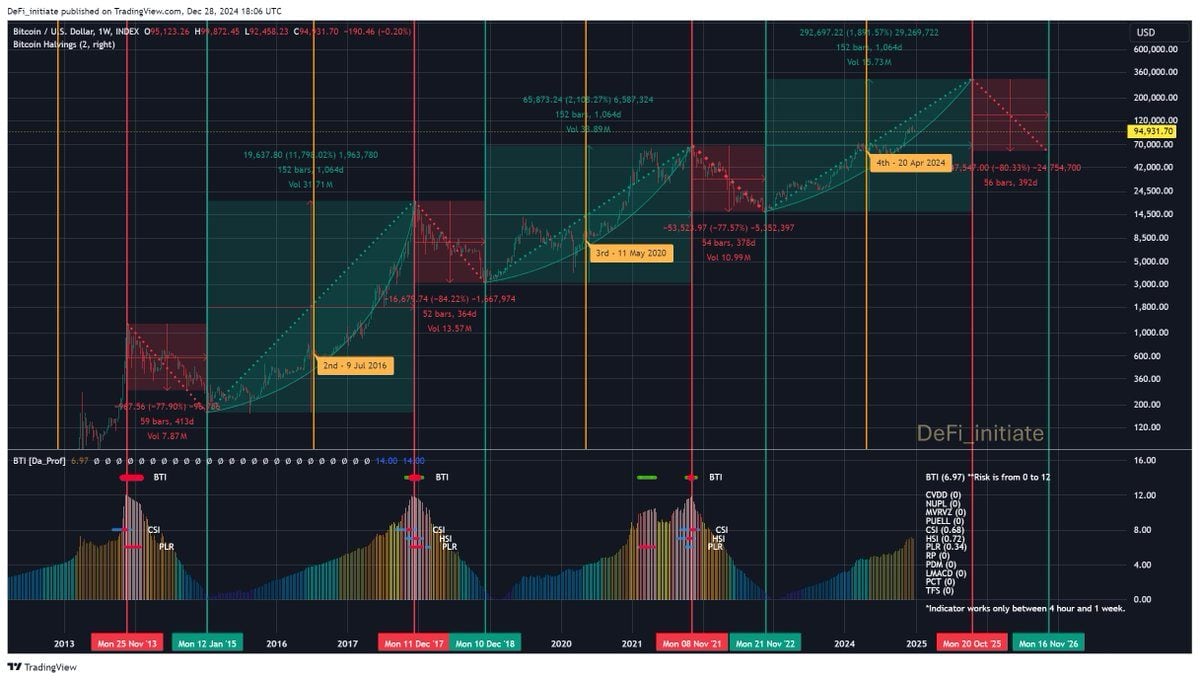

Since bitcoin first hit the scene and started finding its value, it’s been through quite the rollercoaster. Bitcoin enjoyed bullish climbs in 2012-2013, 2016-2017, 2020-2021, and 2023-2024, following a pattern that’s been pretty predictable thanks to the halving events that occur roughly every four years. With each peak, BTC’s price soared high, only to plummet by 75% to 80%+ during the subsequent bearish slumps. However, this bull run has seemingly taken a different turn, with a flood of institutional interest from both private and public sectors and exchange-traded funds (ETFs). Moreover, El Salvador and the Kingdom of Bhutan are now using BTC as part of their reserves, and other countries might soon follow suit.

A Republican Senator from Wyoming, Cynthia Lummis, has put forth a bill suggesting the U.S. should have its own strategic bitcoin reserve. With Donald Trump winning the 2024 election and his comments on the matter, some bitcoin advocates are hoping Trump’s administration, with support from the new Congress, will make this a reality. Bitcoin.com News explored a speculative scenario where Trump does this, potentially igniting the fires of global hyperbitcoinization. What if, instead of sticking to the traditional four-year cycle, we’re entering a bitcoin super cycle where hyperbitcoinization propels BTC prices to heights previously only fantasized about?

There’s a chance there would be no dramatic 75% to 80% crash, and one might confidently argue that BTC dipping below six digits would become a thing of the past. A bunch of Redditors in the thread were totally on board, believing this might just be the reality for the current cycle. “It’s often wishful thinking. People think they can sell the top and jump back in at $50k. I do not think that will happen this time around,” one individual commented. In reply to that comment, one Redditor chimed in stating:

You could well be right. If not, then the next bear market for crypto could well be the last. All this institutional/sovereign/national money is going to completely change the game.

While some hold fast to the cyclical blueprint of bitcoin’s past, the evolving geopolitics and mounting institutional activity hint at a bolder, less predictable future. “If demand continues to dominate and halvings have less predictive power, we might see the 4-year cycle narrative dissolve over time,” another Redditor remarked in the post. “The market could stabilize, trading more on fundamentals and less on halving hype. In that sense, future halvings matter less as a price driver and more as a symbolic checkpoint for bitcoin’s deflationary design.”

As the dialogue around hyperbitcoinization intensifies, the notion of unwavering cycles edges toward extinction. Whether or not a supercycle emerges, market watchers remain eager to witness the shape of bitcoin’s next act—and potential future surprises.

Source:news.bitcoin.com