Cryptocurrency analytics firm Alphractal has released its latest market analysis, revealing interesting activity across Bitcoin’s core address categories.

Cryptocurrency analytics firm Alphractal has released its latest market analysis, revealing interesting activity across Bitcoin’s core address categories.

According to the analysis, wallets with 100 to 1,000 BTC, dubbed “Dolphins,” are the only group currently actively accumulating Bitcoin, while all other categories of addresses are in a distribution phase, suggesting that they are selling their holdings.

“Since most addresses above 1,000 BTC belong to exchanges, this category seems to represent institutional action better than others,” Alphractal said.

Dolphins reached their peak of accumulation on Dec. 6, holding around 344,000 BTC after a 60-day buying spree. However, last week, the group sold 11,000 BTC, contributing to the recent market volatility. Despite this, the analysis notes that it is “too early to conclude that accumulation has stopped” and recommends monitoring on-chain metrics closely for more insight.

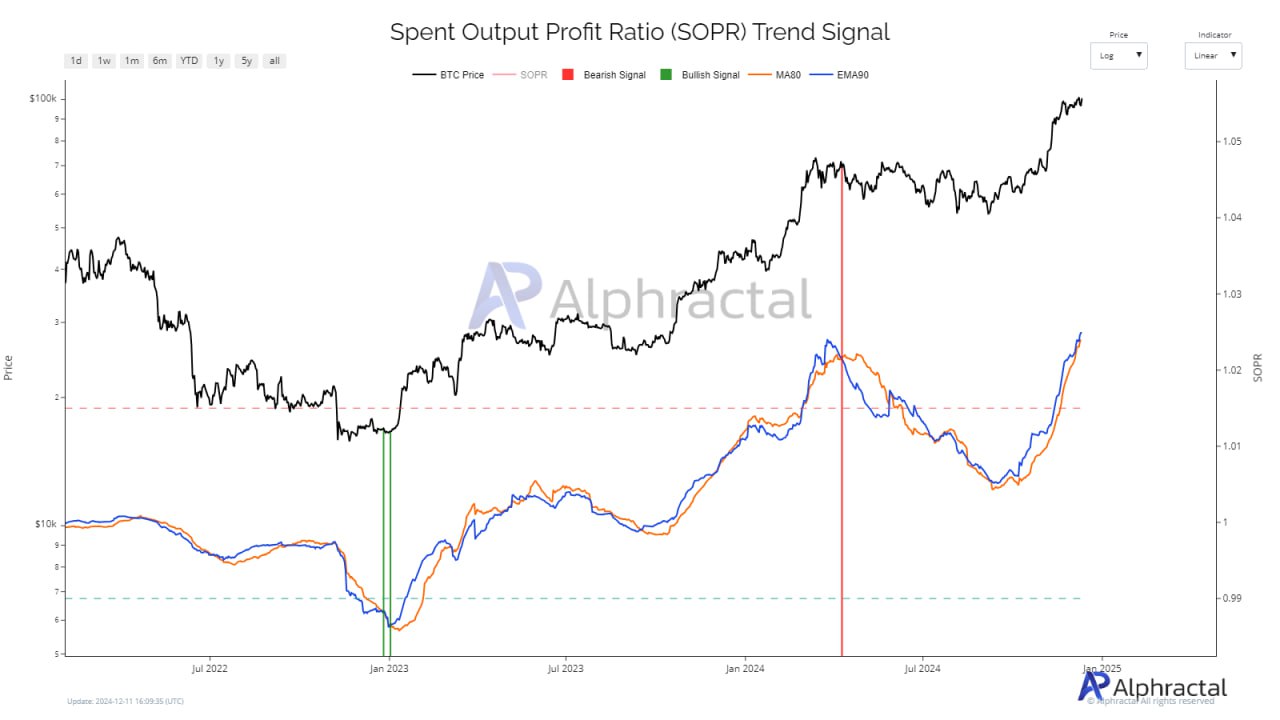

The report also highlighted the SOPR (Spent Output Profit Ratio) Trend Signal, a key metric for assessing Bitcoin’s price trends. This metric measures profit-taking behavior in the market and has historically been a reliable predictor of trend changes.

Currently, the SOPR Trend Signal is approaching a critical threshold. According to the analytics firm, if the blue line crosses below the orange line, a sell signal will be triggered, indicating that enough dispersion has occurred to trigger a downward price trend. However, Alphractal noted that these signals are often delayed, with trend changes typically occurring days after the metrics cross.

Source:en.bitcoinsistemi.com