Bitcoin rallied 6.15% on Nov. 10 to reach another new all-time high of $81,358.

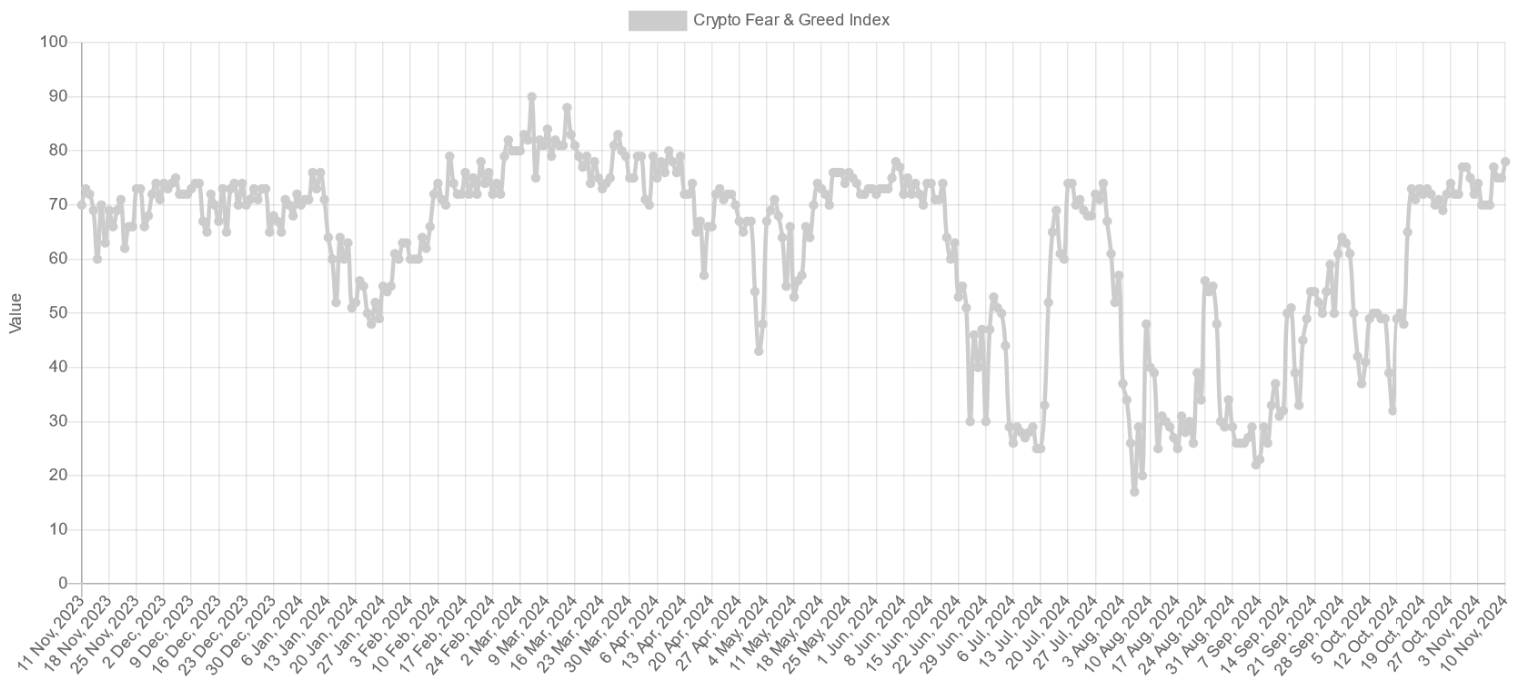

The Crypto Fear and Greed Index, which measures market sentiment for Bitcoin and other cryptocurrencies, hit its highest level of “greed” in nearly seven months on Nov. 10 as Bitcoin crossed $81,000.

The index notched a score of 78 out of 100 — in the “Extreme Greed” zone, the highest it’s been since April 12 — when Bitcoin was trading around $70,000 and the 2024 halving event was fast approaching.

Bitcoin hit the “Extreme Greed” zone (75-100) on Oct. 31 and has hovered between 70 and 78 over the last week as Republican Donald Trump took out the United States presidential election.

Bitcoin rallied 6.15% to a new all-time high of $81,358 on Nov. 10 but has since cooled off to $80,182 at the time of writing, according to CoinGecko.

The Crypto Fear and Greed Index score has also since slightly regressed to 76 out of 100 on Nov. 11.

However, industry analysts anticipate Bitcoin will see far more upside before Trump is inaugurated on Jan. 20, 2025.

The index produces a score based on market volatility (25%), trading volume (25%), social media sentiment (15%), Bitcoin’s dominance (10%) and trends (10%) to reach an overall score. It used to account for surveys (15%), but that metric is currently paused.

Bitcoin is starting to trend on Google

Meanwhile, Bitcoin’s recent price pump seems to have woken up more retail investors over the last week as Google search interest for “Bitcoin” has risen substantially.

However, it’s still far off from the last bull run, with current search interest for Bitcoin scoring 48 out of 100 relative to late May 2021, when all-time search volumes reached their peak, per Google Trends data.

Bullish sentiment has been fueled by Trump’s victory and a larger representation of pro-crypto politicians winning seats in the US Senate and House of Representatives for the 2025-2029 term.

Market participants may also benefit from a potentially more accommodating Securities and Exchange Commission should Trump fulfill his promise to remove Gary Gensler as the SEC’s Chair.

Mark Uyeda, an SEC commissioner who has criticized the SEC’s regulation by enforcement regime, could be next in line to replace Gensler, according to crypto attorney Jake Chervinsky.

Source: cointelegraph.com