Trump’s return to the White House sparked a major crypto rally that caught bears off guard and wiped out hundreds of millions in short positions.

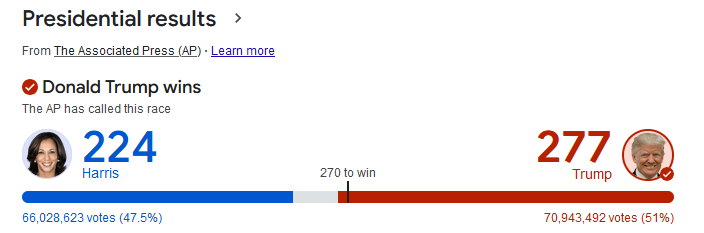

- Trump secured the presidential race.

- Crypto markets rallied in response.

- Short sellers were caught off guard.

Donald Trump reclaimed the US presidency for a second term, declaring victories in pivotal swing states like North Carolina, Pennsylvania, and Georgia. This has sparked a major rally in the crypto market, with investors eyeing the potential for a pro-crypto administration.

In response, the total crypto market cap surged by $270 billion, delivering double-digit gains across most of the top 100 tokens. Meanwhile, short sellers have taken a hit, facing large-scale liquidations as bullish sentiment sweeps through the market.

Short Sellers Get Burned

With Trump winning a second presidential term, crypto markets surged in anticipation of a pro-crypto administration. The total crypto market cap hit a 15-week high of $2.48 trillion as of Wednesday morning (GMT) in response.

This bullish momentum put pressure on shorters, with Coinglass data showing $310 million in liquidations for shorts on November 6.

Reflecting this shift, the long-short ratio rose to 1.0585, marking the first instance since October 29 where buy volume outpaced sell volume, underscoring renewed optimism across the market as Trump secured a second term.

Trump’s Crypto Pledges

BlackRock CEO Larry Fink recently stated that crypto’s future looks bright regardless of who wins the election, yet many Republican supporters see Trump’s victory as a pivotal moment for the industry.

Crypto advocates now anticipate the implementation of pro-crypto policies that could propel the US digital asset industry forward under Trump’s leadership.

During Trump’s election campaign, several pledges were made to support crypto including the formation of a national Bitcoin reserve, the removal of SEC chair Gary Gensler, though it remains unclear if a president has the authority to make such a direct change, and favorable Bitcoin mining policies.

On the Flipside

- Bitcoin hit a new $75,400 all-time on November 6.

- Trump previously stated that crypto is “based on thin air.”

- Gold fell 1.5% while the DXY soared to an 18-week high of 105.313.

Why This Matters

While short sellers nurse their wounds, the crypto industry watches if Trump delivers on his campaign promises.

Source: dailycoin.com