Analysts believe that a new altcoin season is entering its early stages. Cointelegraph digs into the data.

Altcoins have displayed strength following Bitcoin’s recent recovery over the past month. This has lead analysts to suggest that the market might be on the brink of an altcoin season.

“The past few days have been very bullish for many #Altcoins!” ParabolicPump, co-founder of Crypto Capital, said in a Sept. 23 post on X.

Popular trader 360Trader observed that TOTAL3, the total crypto market capitalization excluding BTC and ETH, had retested the upper boundary of a falling channel.

Although this crucial level has suppressed the price since March, 2024, a decisive close above it would confirm a “nail in the coffin for bears,” they said.

According to ParabolicPump as altcoin price rallied, Bitcoin’s dominance is on the verge of a downside breakfrom its rising wedge. “It is only a matter of time,” the analyst pointed out, adding:

“Every bull run in crypto had a phase where Bitcoin dominance dropped to the downside significantly.”Bitcoin dominance 2-week chart. Source: ParabolicPump

As of Sept. 23, Bitcoin’s dominance is 57.39%, down 1.09% over the past week, according to data from Cointelegraph Markets Pro and TradingView.

Traders often look for signs that Bitcoin dominance is peaking as a signal for investors to sell BTC and rotate their capital into alternative coins.

According to popular analyst Nebraskangooner, Bitcoin dominance’s recent rise to 58.61% might have marked the top for this metric as a bearish divergence from the relative strength index (RSI) signaled a weakening market structure for BTC.

Meanwhile, pseudonymous analyst Moustance observed that TOTAL2, the altcoins’ total market cap excluding BTC, was in the process of breaking out of a descending broadening wedge that has been in play for the past six months.

Moustache explained that the optimistic outlook for altcoins was supported by the RSI breaking out of a downward trend and an impending bullish cross from the moving average convergence divergence indicator.

“A god candle like we haven’t seen for years is loading, in my opinion.”Altcoin market capitalization. Source: Moustache

In a follow-up post, the analysts said charts and onchain data show that the market is going to “see the biggest bull run since 2017.”

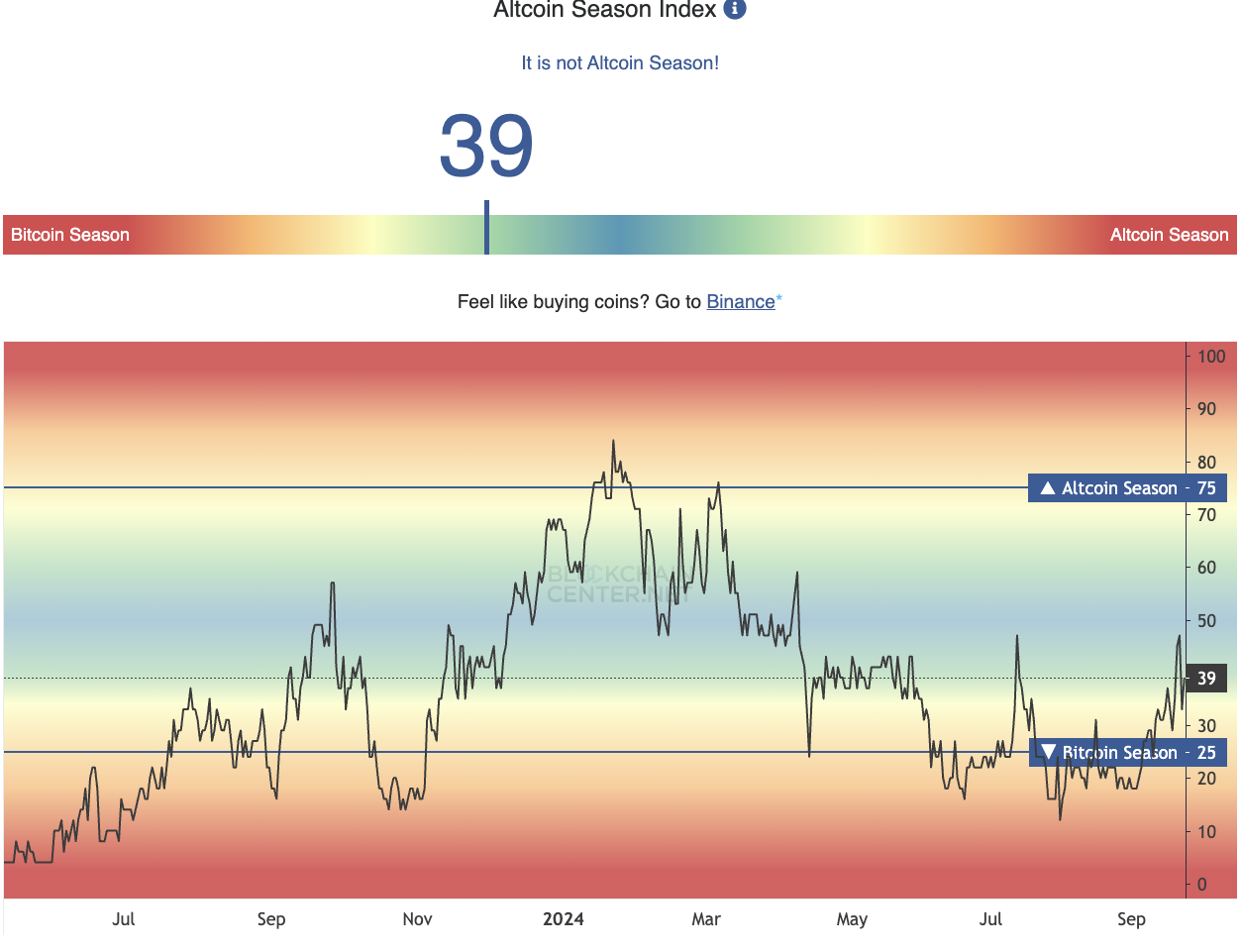

However, it’s not time to celebrate yet as the altcoin season index by Blockchain Center, indicates that the altseason is not yet here. According to this index:

“If 75% of the top 50 coins performed better than Bitcoin over the last season (90 days), it is the Altcoin Season.”

Despite the compelling technicals, it might still be too early to conclude that an altcoin season has begun. The chart below shows that only 39% of the leading 50 altcoins have outperformed Bitcoin in the last 90 days. Since the index is less than 75, it indicates that it is not yet altcoin season.

Source: cointelegraph.com