-

A 25 basis point Federal Reserve cut would be positive for markets, but a higher 50 point move would signal growing concerns of a recession and a deeper correction for risk assets, Bitfinex said in a report.

-

A September price drop would present a buying opportunity with a seasonally strong period ahead, K33 said.

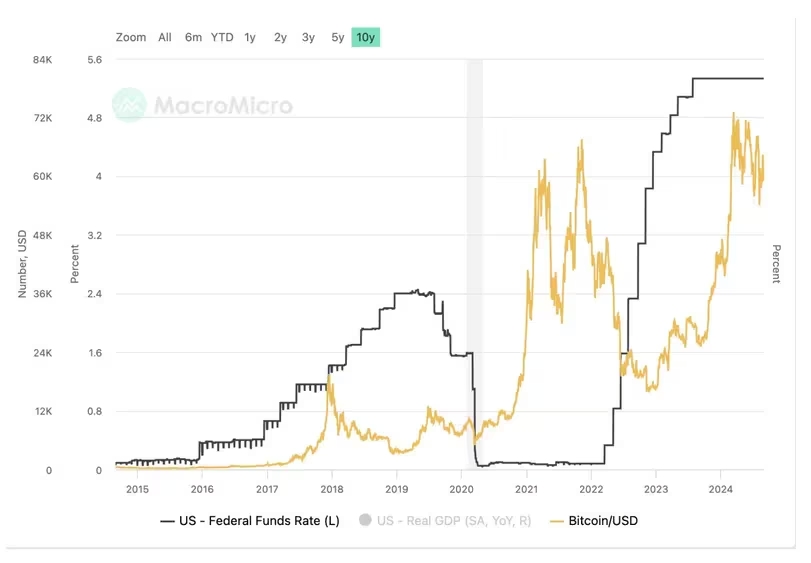

Worn down by months of lackluster price action, crypto investors were looking forward to the Federal Reserve cutting interest rates in September as a catalyst for a bull move, but escalating recession fears could bring a deeper correction, according to analysts at Bitfinex.

Bitcoin could drop as much as 15%-20% following a September rate cut if the easing cycle is paired with a recession, wrote the team. That would translate to a bottom somewhere in the $40,000-$50,000 range.

“Typically, rate cuts are perceived as bullish catalysts for risk assets,” they wrote. “A 25 basis point rate cut would likely mark the beginning of a standard rate-cutting cycle, which could lead to long-term price appreciation for BTC as recession fears ease. Such a move would signal the Fedʼs confidence in the economyʼs resilience, reducing the likelihood of a severe downturn.”

Alternatively, a larger 50 basis point cut might result in a short-lived 5%-8% spike for BTC only to be erased by growing concerns of an oncoming recession and more pain for asset prices, Bitfinex added.

“This would mirror past instances where aggressive rate cuts initially boosted asset prices, only for the gains to be tempered by rising economic uncertainties,” the authors said.

Brighter months after September

All the doom and gloom for the month ahead could present an attractive buying opportunity for investors with more favorable months coming after, crypto analytics firm K33 Research argued in a report.

The period from October to April has been historically the strongest time for bitcoin. “An investor opting to buy the October open and sell the April close would have seen 1,449% returns since 2019, while a trader opting for the opposite strategy would have seen net negative returns,” Lunde said

There are also some positive catalysts for a strong year-end, the report added.

The large selling pressure from various government entities and Mt. Gox have mostly abated, while about $14.5 billion of funds will be redistributed to FTX creditors later this year, with bulls hoping a part of that money will be reinvested in the crypto market.

Source: coindesk.com