Bitcoin bulls draw key battle lines as market metrics hint at a potential breakout from the short-term BTC price trading range.

Bitcoin took liquidity both up and down on Aug. 22 as analysis said crypto markets are “looking ripe for a short squeeze.”

Bitcoin took liquidity both up and down on Aug. 22 as analysis said crypto markets are “looking ripe for a short squeeze.”

Key BTC price hurdles crystallize

Data from Cointelegraph Markets Pro and TradingView shows volatile BTC price moves within a narrow range over the past 24 hours.

United States employment data revisions, along with the minutes of the Federal Reserve’s latest meeting, helped spark a rally for BTC/USD the day prior.

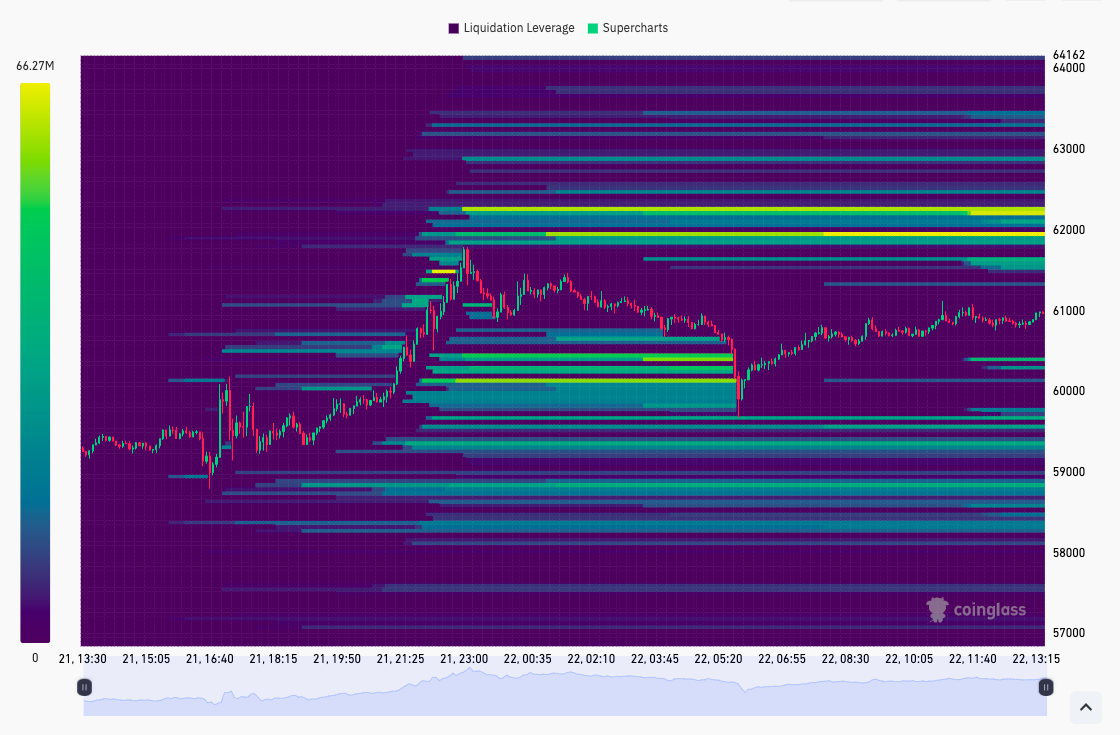

This was short lived, however, with a return to $59,500 helping liquidate late longs before a fresh rebound to $61,000.

The latest figures from monitoring resource CoinGlass put 24-hour total crypto liquidations at $124 million at the time of writing.

It also showed ask liquidity increasing above $62,000, turning the level into the key target for a resistance/ support flip.

Analyzing the current status quo, popular trader Crypto Feras noted that BTC/USD had retested the area five times in the past two weeks.

The more it is tested, the weaker it gets. Logically, less efforts are needed to flip it after all these tests,” he wrote in part of a recent X post.

“Flipping it means 64.8-65k is next.”

While stuck in a narrow trading corridor, Bitcoin nonetheless inspired some hopes for a solid breakout based on market conditions.

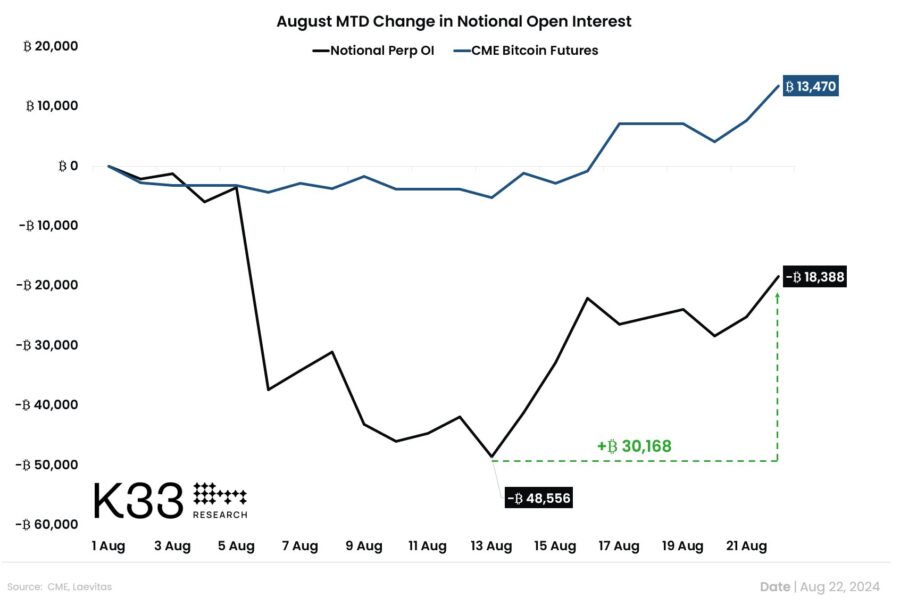

Vetle Lunde, senior analyst at crypto analytics firm K33 Research, flagged rising open interest along with consistently low funding rates potentially giving rise to a “short squeeze.”

“Market conditions are looking ripe for a short squeeze,” he told X followers.

“BTC perps notional open interest has jumped by 30k BTC since August 13, with consistent negative funding rates. Average weekly funding rates have hit their deepest negative since March ’23.”

Bitcoin speculators still far from breakeven point

Further up, another key area for BTC price is the short-term holder realized price, now centered around $65,000.

This refers to the average buy-in price of investors holding coins for up to 155 days.

In bulls markets, the level traditionally acts as support, with price last falling below it for a significant length of time in August 2023.

“We can say that the 64K – 66K region is a strong resistance level for Bitcoin,” Burakkesmeci, a contributor to onchain analytics platform CryptoQuant, wrote in a blog post on the day.

“When short-term holders start closing their losses and moving into profit, they will likely share their success stories. These stories have the potential to attract new investors to Bitcoin.”

Source: cointelegraph