Bitcoin’s recent price struggle encouraged whale and shark wallets to buy more amid the small-scale holders’ sell-off. Data from blockchain analytics firm Santiment confirmed this, noting that the number of addresses holding at least 10 BTC has increased by 261 this month.

Also Read: Germany loses Bitcoin billionaire status, now holds less than 10k BTC

With the increase in accumulation among large holders, experts believe strong bullish optimism is returning. This is a good sign for Bitcoin’s long-term projections.

Retail panic sells in the face of a dip

Bitcoin has witnessed major price volatility over the past few weeks, going as low as $53,000 on July 5. The massive drop in value and the continuous price volatility have forced many small traders to sell their holdings, likely in a panic reaction to the plunge in price.

However, holders who fall into the sharks and whales category have been busy accumulating. Sharks hold 10 to 1,000 BTC, while Whales hold more than 1,000 BTC. For these cohorts, the price decline has created an entry point, allowing them to buy for the long term.

Signs of this accumulation have been evident in the increase in the number of wallets holding at least 10 BTC. Santiment data shows that over 152,000 addresses now hold 10+ BTC, the highest number since May 21. The increasing rate of accumulation is also reflected in the inflow of capital into the crypto market through stablecoins, with the minting of $750 million in USDC during the last seven days on the Solana blockchain.

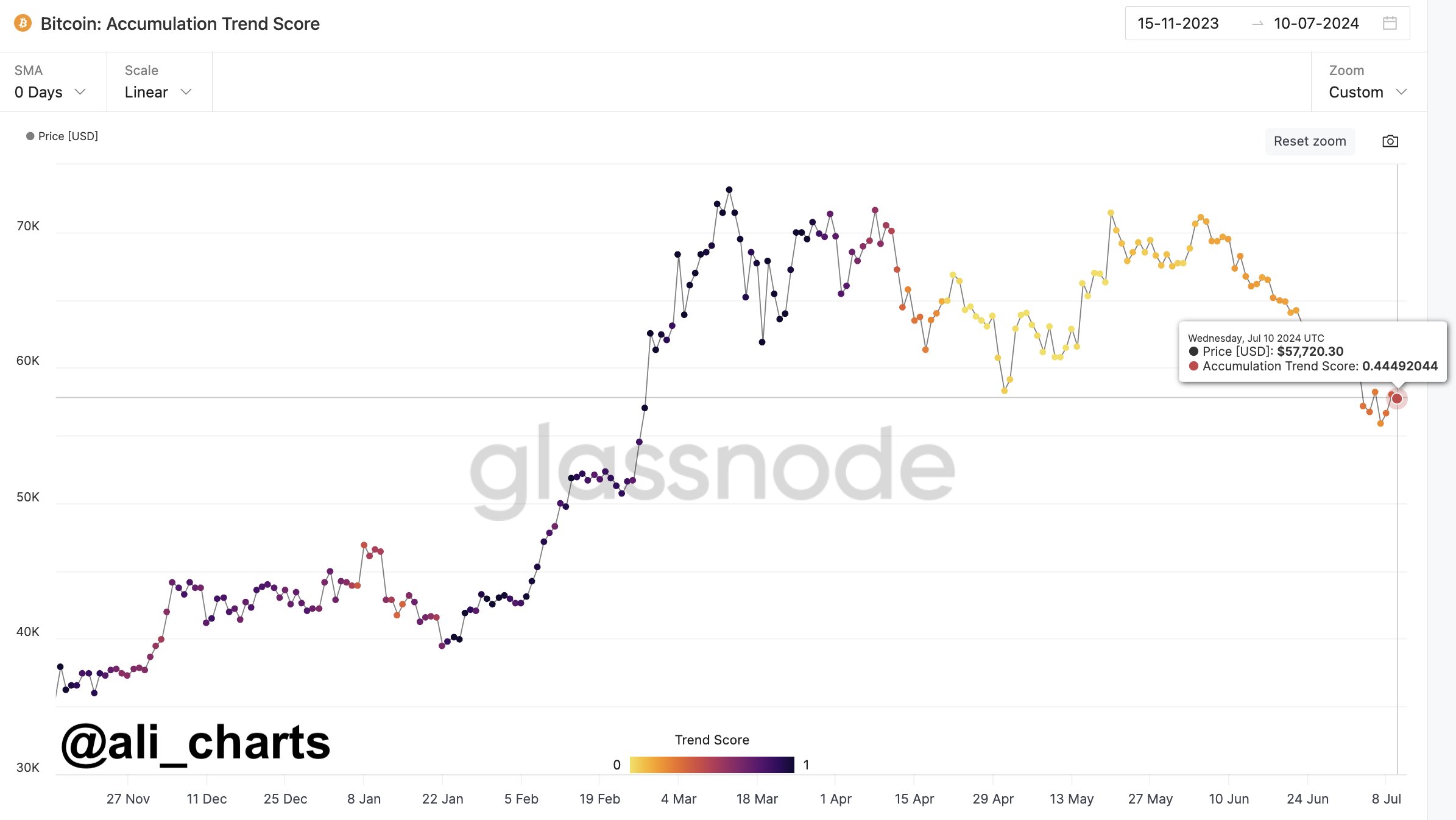

Meanwhile, the increase in the Bitcoin accumulation trend score further supports bullish sentiments. Technical analyst Ali Martinez noted that the score, currently at 0.4449, “indicates a change in investors’ sentiment, with many now choosing to accumulate $BTC.”

Bitcoin remains volatile

Despite the increasing accumulation trend score, Bitcoin has fallen 1% in the last 24 hours, wiping out all its earlier gains in the day. The flagship asset, which rose as high as $59,387, has now dropped to $57,000, highlighting recent volatility.

Also Read: Governments turned Bitcoin (BTC) whales continue to put pressure on the market

Price performance has already affected derivatives traders, causing liquidations of both bearish and bullish positions. Coinglass data shows that $32.38 million was liquidated in the last 24 hours. Most of the liquidated positions came from those who longed for the assets.

Meanwhile, the current price performance represents the worst price correction since 2022. According to Glassnode, this has left most short-term holders with paper losses. Based on the on-chain acquisition price, over 2.8 million BTC are currently being held at a loss.

Source:cryptopolitan.com