Key Points:

- Bitcoin miners transfer $174M worth of coins to exchanges since May 31, Glassnode data shows. On June 3 alone, miners moved 2,606 BTC to exchanges, the largest single-day tally in over four years. The 14-day average of miner transfers to exchanges has increased sharply to 489.26 BTC, the highest since March 2021.

- Increased movement of coins from miners to exchanges is widely perceived as bearish, but it amounts to just 1.3% of BTC’s 24-hour trading volume of $13 billion and does not appear big enough to have a sizable impact on BTC’s price.

- Increased miner transfers often represent confidence in BTC’s price prospects, as miners’ profitability is closely tied to BTC’s price.

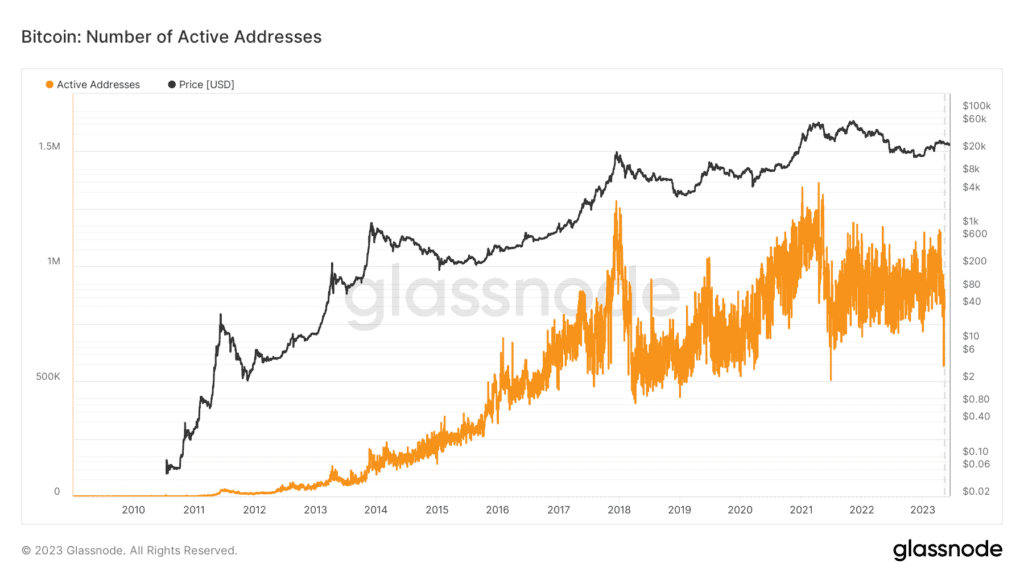

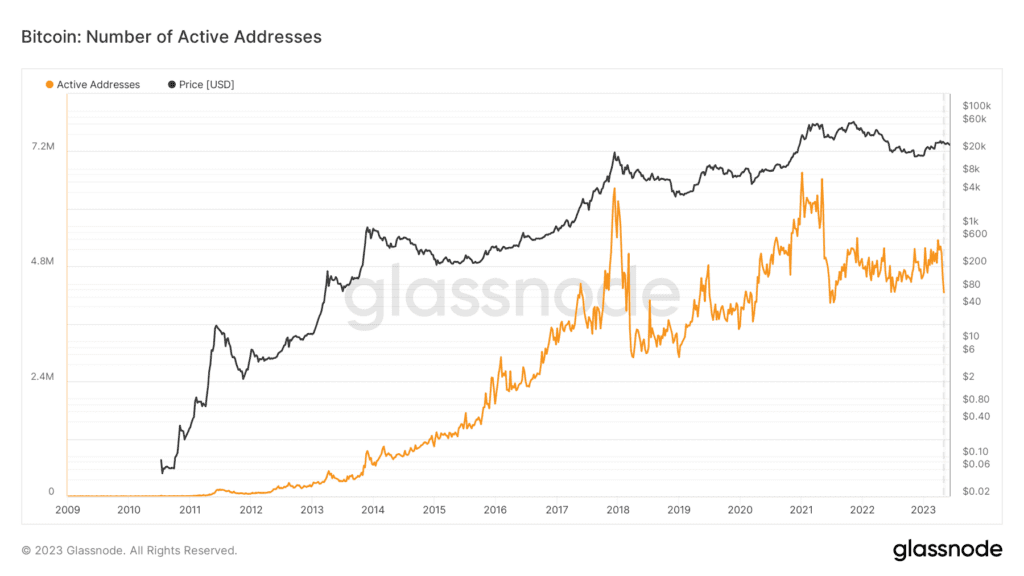

According to recent data tracked by blockchain analytics firm Glassnode, there has been a significant increase in the transfer of bitcoin miners to centralized exchanges since May 31.

Over the last two weeks, miners or entities minting coins by verifying transactions on the blockchain have moved a total of 6,671.99 BTC ($174 million) to exchanges, with 2,606 BTC moved in a single day on June 3 – the largest daily tally in over four years. The 14-day average of miner transfers to exchanges has also risen sharply to 489.26 BTC, which is the highest since March 2021.

The transfer of coins from miner or investor wallets to exchanges is often viewed as a sign of intention to sell or liquidate the coins, which is usually perceived as bearish. However, the recent transfers represent only 1.3% of bitcoin’s 24-hour trading volume of $13 billion, which may not have a significant impact on the cryptocurrency’s price.

The increased miner transfers may also indicate confidence in bitcoin’s price prospects. According to a recent article, miners’ profitability is closely linked to bitcoin’s price, and they tend to increase their sales when they believe the market can handle extra supply. This is similar to a central bank of a country with a current account deficit buying U.S. dollars in the open market when the greenback is on offer across the board. In this way, they can build up reserves without risking the depreciation of their own currency.

Glassnode’s data suggests that there has been a notable shift in the movement of bitcoin from miners to exchanges in recent weeks, which could have implications for the cryptocurrency’s future price movements.

Source:news.coincu.com