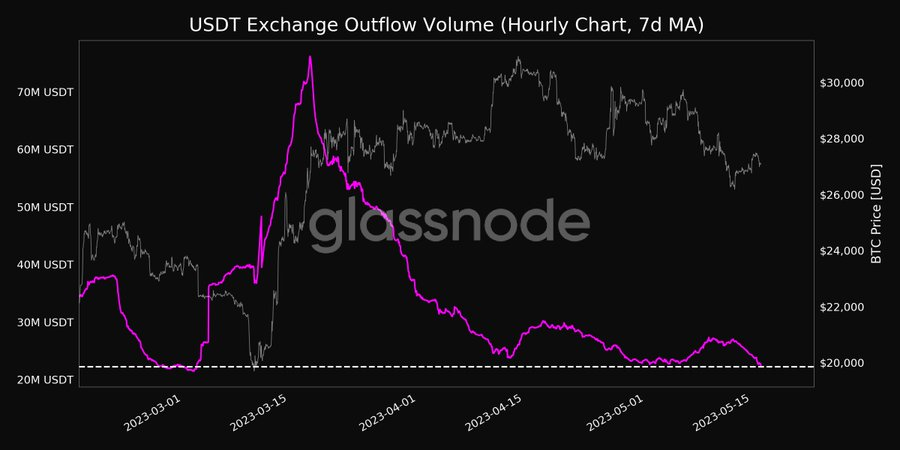

- Glassnode Alerts tweeted this morning that USDT’s exchange outflow volume has reached a new one-month low.

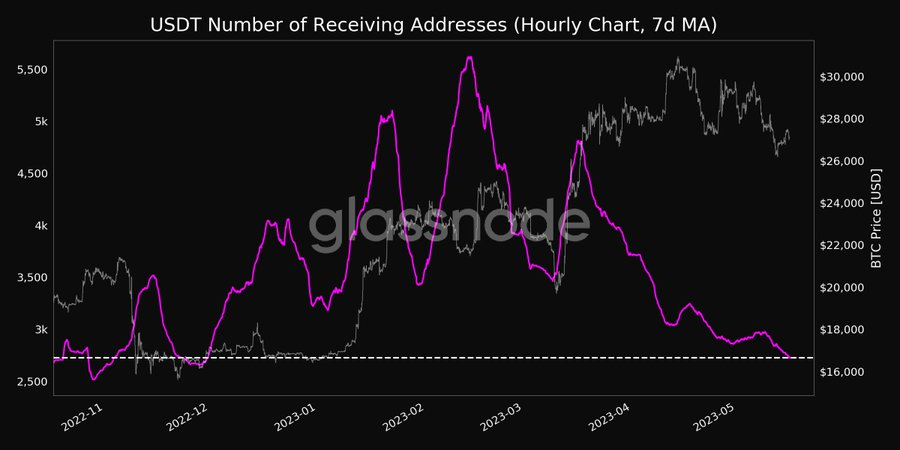

- The firm also showed that USDT’s number of receiving addresses has reached a 5-month low.

- Both of these metrics reaching new lows could be a reflection of the uncertainty in the crypto market.

The on-chain analysis platform, Glassnode Alerts, took to Twitter earlier today to share some new data about Tether (USDT). According to the post, the exchange outflow volume (7d MA) for USDT has reached a one-month low, standing at 22,257,226.754 USDT.

This recent decline marks a decrease from the previous one-month low of 22,651,224.549 USDT recorded on May 1, 2023. The exchange outflow volume for USDT establishing a new low means that fewer people are withdrawing or moving USDT from cryptocurrency exchanges.

Glassnode also tweeted this morning that the number of receiving addresses for USDT has recently reached a 5-month low of 2,724.173. This is a slight decrease from the previous 5-month low of 2,727.774, which was observed on 15 May 2023.

This decline in receiving addresses could suggest a potential decrease in the number of users or entities actively receiving USDT. It could also indicate reduced demand for USDT or a shift in user preferences towards other cryptocurrencies or stablecoins.

The fact that both of these metrics have reached new monthly lows indicates a lack of confidence or uncertainty in the cryptocurrency market. Traders may be hesitant to make significant moves with their USDT due to market volatility or other factors affecting the broader crypto ecosystem.

When looking at CoinMarketCap, it seems the past 24 hours have not been kind to most cryptocurrencies in the market. The majority of the top 10 cryptos by market capitalization suffered price losses throughout the past day.

This included both market leaders, Bitcoin (BTC) and Ethereum (ETH), who experienced respective price losses of 0.85% and 0.62% during this period. Meanwhile, other altcoins like XRP, Cardano (ADA), Polygon (MATIC), and Solana (SOL) all saw price declines of more than 1%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Source: coinedition.com